Share Article

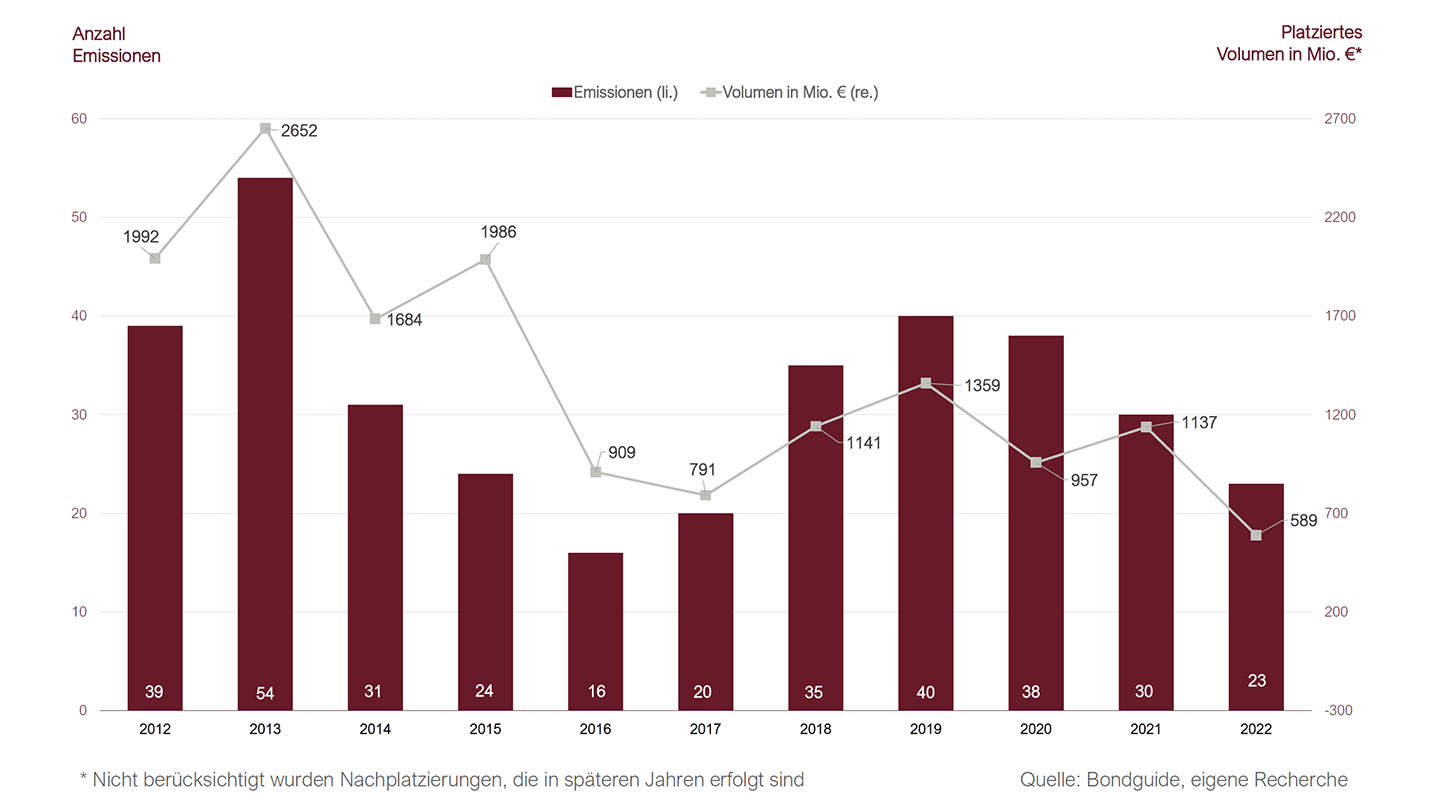

Cologne, 25 January 2023 - The year 2022 was marked by numerous geopolitical crises in the German SME bond market, as in the financial markets as a whole, resulting in lower primary market activity. The number of issues decreased compared to the strong previous year, as did the volume placed with investors.

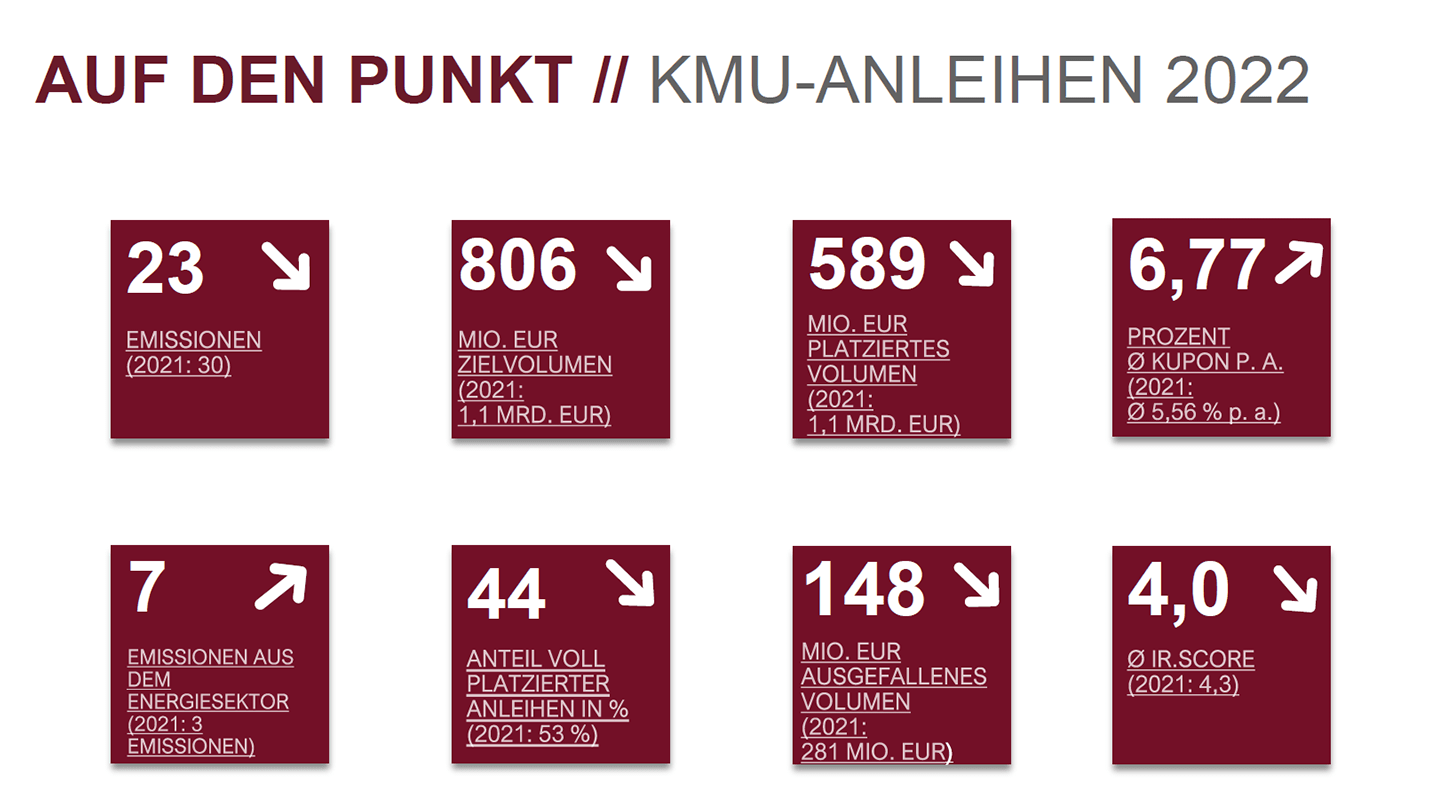

A total of 23 SME bonds (2021: 30 bonds) were issued by 19 companies with a target volume of EUR 806 million, including well-known brands such as FC Schalke 04, the traditional company Semper Idem Underberg, and Katjes Greenfood, which focuses on new food concepts. The volume placed fell to EUR 589 million, corresponding to a placement rate of 73%. The average annual coupon increased by more than one percentage point to 6.77% (2021: 5.56%) in the wake of higher interest rates. Due to the difficult market environment the need for restructuring in the form of adjustments to bond terms such as maturity extensions or interest rate adjustments increased. The default volume, however, fell from EUR 281 million in the previous year to EUR 148 million in 2022, according to an annual review of the German SME bond market conducted by investor relations consultancy IR.on AG.

Frederic Hilke, Senior Consultant and Head of IR Consulting at IR.on AG: "The increased interest rate level and the turbulence on the financial markets have also brought the SME bond market to a standstill in some phases. However, with more than 20 issues and around EUR 589 million in financing volume, the segment remains an important financing channel for SMEs in particular."

Energy sector dominates transaction activity

The 23 bonds issued by the 18 SME bond issuers were spread across eight different sectors last year (previous year: 14 sectors). For the first time since the launch of the survey in 2015, the primary market for SME bonds was dominated by the energy sector rather than the real estate sector. A total of seven bonds were issued by companies from this sector, followed by the real estate sector (five issues) and the chemicals sector with three issues.

Fourteen of the 23 bond issues were subsequent issues, which also achieved a significantly better placement rate (89%) than the nine bonds from debut issuers (55%). The stock market listing also had a positive impact on placement success. The four bonds issued by listed companies were all fully placed.

In terms of placement form, the clear trend towards public offerings was confirmed, dominating the market at 83% (2021: 87%). The objective of placement security in a difficult market environment plays a key role here, which is increased by public placements.

There was a significant decrease in bond defaults, which fell from EUR 281 million to EUR 148 million in 2022. The bonds affected were those of the Green City Group, Terragon AG and Quant.Capital GmbH & Co. KG.

There was a significant decrease in bond defaults, which fell from EUR 281 million to EUR 148 million in 2022. The bonds affected were those of the Green City Group, Terragon AG and Quant.Capital GmbH & Co. KG.

By contrast, the number of bonds affected by restructuring (including maturity extensions, interest rate adjustments) increased significantly to a total volume of EUR 690 million (2021: EUR 60 million) as a result of the limited refinancing options available on the market.

Forecast 2023: Further increase in coupons; issuance activity at prior-year level

IR.on AG surveyed eight issuing houses and banks active in the SME segment on their outlook for 2023. On average, they expect 22 issues in the current year. The main drivers are subsequent issues and pending refinancing - lively issuance activity is expected here, especially in the second half of the year.

Frederic Hilke: "In the first half of the year, issuance activity is expected to remain subdued due to existing market uncertainties. With inflation gradually falling and interest rates stabilizing, according to the banks surveyed, momentum will return to the market in the second half of the year - especially through subsequent issues by established issuers."

In terms of coupon development, seven of the eight respondents expect interest rates to rise in 2023 - primarily due to the general rise in interest rates and investors' demand for higher risk premiums.

In addition to increased transparency and stricter covenants, issuing houses expect further growth in the importance of implementing ESG standards, some of which will be mandatory for 2023, in order to raise funds through increasingly sought-after "green financing."

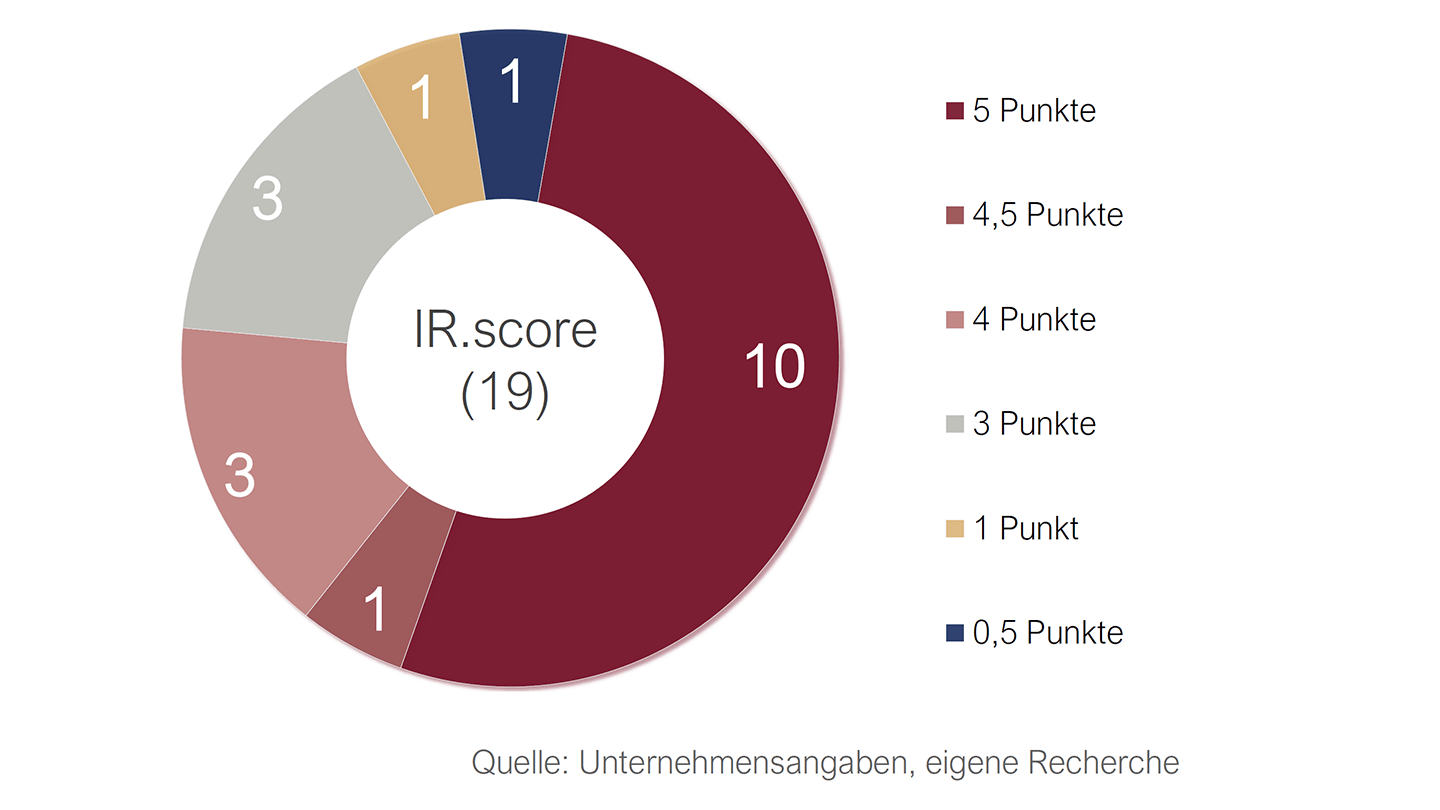

IR.score slightly down on previous year at 4.0 points

Overall, the communication of bond issuers in 2022 exhibits solid transparency, as shown by the investor relations work examined in the study. In this year's review of the IR websites of the 19 issuers with regard to basic IR information, the average transparency index "IR.score" was 4.0 points (out of a maximum of 5 points), compared with 4.3 points in the previous year.

A summary of the survey is available on the IR.on AG website at https://ir-on.com/en/sme-bonds/.

About IR.on AG

IR.on AG is an independent consulting firm for investor relations, financial and sustainability communications. The agency assists companies of all sizes across all industries in the development of investor relations strategies, day-to-day IR activities, as IR interim manager, in capital market transactions and in special situations such as crises or restructurings, as well as in press relations with financial and business media. In addition, the agency advises companies on the development and implementation of ESG/sustainability strategies and the preparation of sustainability reports. The company, founded in 2000 and based in Cologne and Frankfurt am Main, is owner-managed. IR.on AG's consultants combine experience from more than 400 communications projects, more than 300 realized financial and sustainability reports, and more than 100 capital market transactions, including 38 SME bond issues.

Contact

IR.on AG

Mittelstr. 12-14, House A

50672 Cologne, Germany

T +49 221 9140-970

E info@ir-on.com

www.ir-on.com