Share Article

Cologne, 24 January 2025 – Sustainable financing is a much-discussed topic these days and the growing importance of this form of financing is usually mentioned. However, a closer examination of the SME bond market does not fully confirm this thesis. In addition, a multitude of terms, standards and market practices leads to uncertainties among issuers, potential investors and stakeholders.

In our webinar " Green bonds in practice: from standards over structuring to communication" on the 23rd of January 2025, Dirk Hübner (ABO Energy), Christoph Hirth (Bankhaus Metzler) and Samuel Stott (IR.on AG) discussed current market developments, terminology and took a look at recognised standards. Our experts also provided practical insights into the placement of the ABO Energy Green Bond, which took place in May 2024.

The market for sustainable bonds was evaluated and analysed as part of the recently published IR.on study "Review of 2024 and outlook 2025 for the SME bond market".

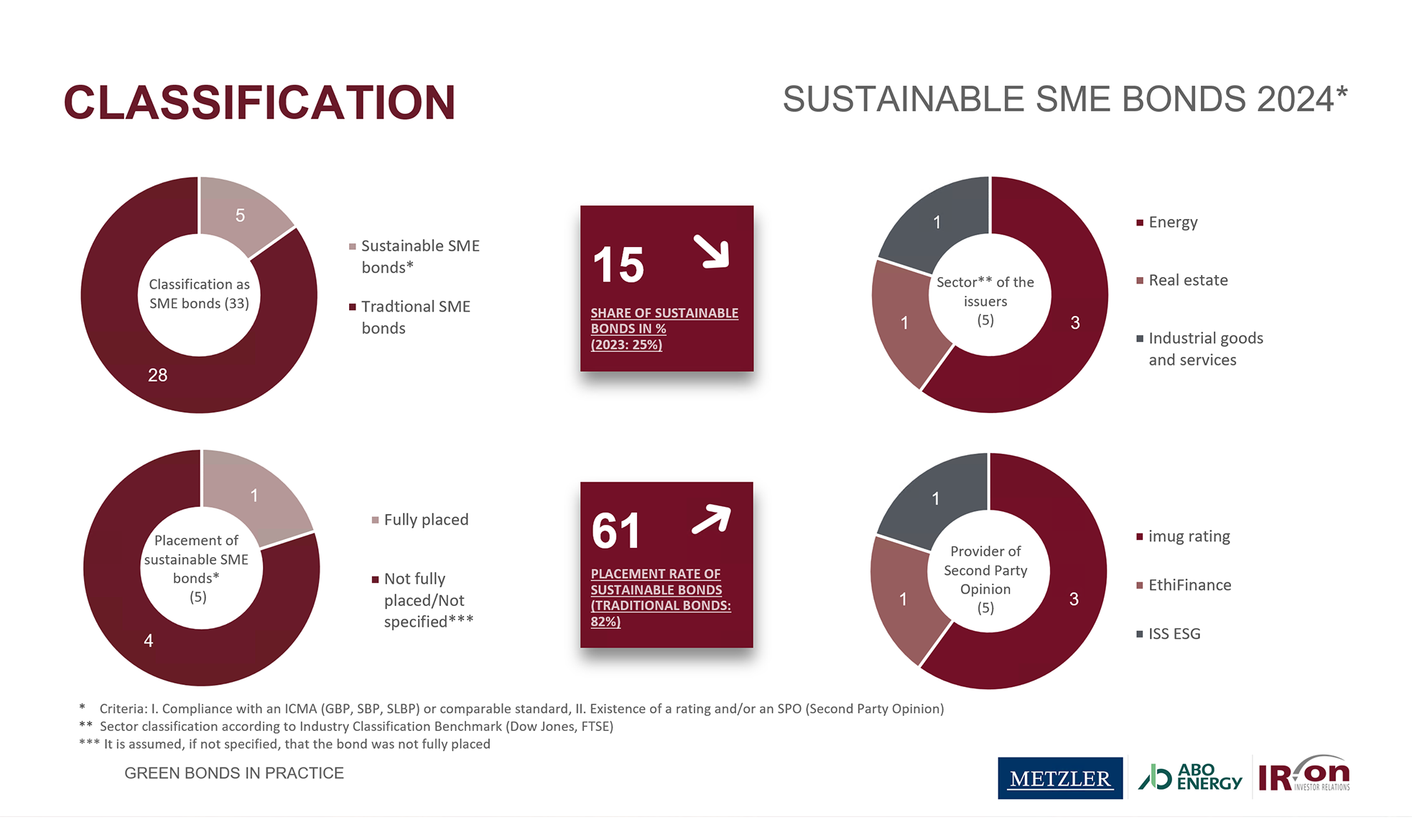

In 2024, five sustainable SME bonds were identified, the majority of which had an SPO of imug rating (3 out of 5 bonds). This means that sustainable bonds account for 15% of all SME bonds issued, which is lower than in 2023 (25%). At 7.68%, the average annual coupon was below the average interest rate of all SME bonds (8.14%). With a placement volume of EUR 178.7 million and a target volume of EUR 295.0 million in 2024, the identified green bonds had a placement rate of 61%, which was below the average issuer’s placement rate for this year (82%).

In conclusion, our experts identified a variety of strengths and opportunities compared to a “traditional” bond issuance. For example, the issuer can reach a broader investor base and attract new investors, while the ESG/sustainability aspects offer marketing and communication advantages. From an investor's point of view, a green bond offers the opportunity to invest in a sustainable capital investment and possibly further diversify the portfolio.

Generally, our experts predict that the green bond market will continue to grow in importance in the coming years. The ECB's increased "green" focus is also likely to further drive the trend towards sustainable investments. In addition, the green bond standards recently introduced by the EU will define new market practices in the future.

You can request our webinar presentation "Green bonds in practice: from standards over structuring to communication” and a recording of the webinar free of charge by e-mail (German only).

Do you have questions about sustainable bonds or need support with communication in connection with your sustainable bond issue?

Do not hesitate to contact us if you have any questions or need strategic and communicative support, e.g. with the bond story, website, media planning or investor presentation and hotline in the course of your sustainable bond issue. We will be happy to support you.

IR.on Aktiengesellschaft

Samuel Stott

Consultant for sustainability communication and ESG

Phone: +49 221 9140 970

E-mail: esg(at)ir-on.com