Weitere Informationen zum Projekt

PM_KMU_Studie_2020.pdfShare Article

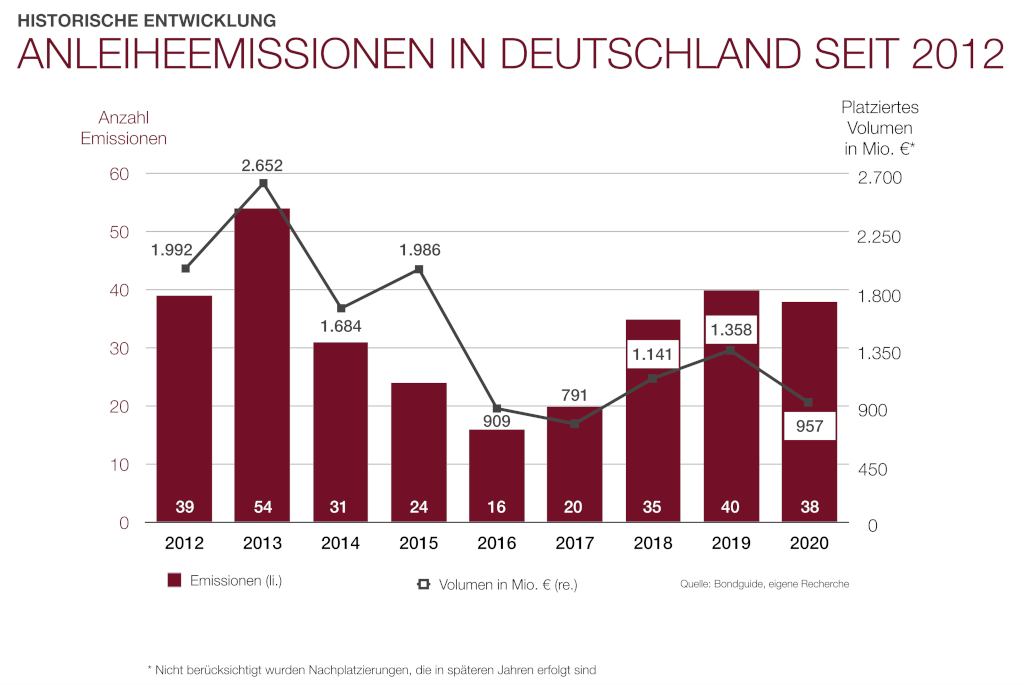

Cologne, 22 January 2021 – As had been expected, the German SME bond market was influenced by the effects of the coronavirus pandemic in 2020. While 38 issues by 34 companies mean that the number of transactions was almost the same as in the previous year (2019: 40 issues by 35 companies), the placement volume of EUR 957.1 million was about 30% below the prior year level (2019: EUR 1.36 billion). This is mainly attributable to the large number of low-volume bonds. In almost half of the issues (16 bonds, 42%), a volume of only up to EUR 10 million was placed (2019: 8 bonds, 20%). Compared to the EUR 1.28 billion target volume of the 38 bond issues, the placement ratio averaged around 75% (2019: 77%). The average annual coupon across all transactions remained at the prior year level of 5.57%. These are the results of a review of the German SME bond market in the past year conducted by investor relations consultancy IR.on AG.

Frederic Hilke, a senior consultant with IR.on AG:

“In spite of the difficult market environment, many companies dared to tap the SME bond market in 2020 and were quite successful in some cases. But as many larger issuers, in particular, were unwilling to accept the increased transaction risks resulting from a pandemic situation that sometimes changes on a daily basis, the issue volumes declined. This means that the SME market is likely to benefit from catch-up effects in the current year as the economic situation stabilizes.”

Real estate sector still dominant

Accounting for 34% of the issues (13 transactions by 12 SME bond issuers), the real estate sector was again the strongest sector in 2020, followed by the food & beverage industry (five issuers and transactions). Third place was shared by the energy sector and the financial services industry, each with four issuers. The range of eleven sectors in total again showed a high diversity of issuers.

The success of the placements was influenced by the increased uncertainty among investors resulting from the coronavirus crisis, with only 15 of the 38 issues fully placed in 2020 (2019: 20 of 40 issues). Fully placed bonds thus accounted for 39% (2019: 50%). The share of fully placed first-time issues (19 bonds, 42% fully placed) and follow-up issues (19 issues, 37% fully placed) was at a similar level during the period under review.

In terms of volume, most of the transactions were in the range of up to EUR 30 million (23 bonds; 61%). Two issues (Porr AG and Rochade Finance GbR) were in the range from over EUR 100 million to EUR 150 million (which is the upper limit of the SME segment according to the criteria of the study). The average placement volume declined from EUR 34 million to EUR 25 million.

Defaults resulting from issuer insolvencies remained at a very low level in spite of the COVID-19 crisis. Joh. Friedrich Behrens AG was the only issuer forced to file for insolvency (two outstanding bonds). The defaulted volume amounted to EUR 36 million in 2020 (2019: EUR 4 million).

Outlook on 2021: Catch-up effects in SME bond market possible

For the outlook on 2021, IR.on interviewed nine issuing houses that are active in the SME segment. They expect an average of 25 issues in the coming year.

Frederic Hilke:

“In spite of the ongoing coronavirus pandemic and although we are in the midst of the second lockdown, issuing houses are more optimistic than they were at the beginning of 2019 (23 issues), citing SMEs’ growing funding needs, catch-up effects from issues postponed in 2020, and the increasing difficulty for many companies to raise bank loans.”

As far as coupons are concerned, four of the nine respondents expect interest rates to rise in 2021, while five bank representatives anticipate stable coupons. They believe that interest rates may decline only for follow-up bonds.

In their opinion, the real estate sector will remain the top sector in 2021. Stronger demand is also expected from companies in the renewables sector. Growing importance is attached to (voluntary) compliance with higher transparency standards. Transparent communication is believed to be critical for the success of an issue. Voluntary self-commitment replaces the regulations and, consequently, the significance of a stock exchange segment or provision of a rating.

On the whole, bond issuers’ communication deteriorated slightly in 2020, judging from the investor relations activities examined in the study. In this year’s review of the IR websites of the 34 issuers with regard to basic IR information, the average “IR.score” transparency index was 3.8, compared to 4.2 in the previous year. Close to one third of the websites (10 issuers) reached a score of 3.5 or lower, which means that they do not meet the information standards expected by investors.

Frederik Hilke:

“First-time issuers, in particular, continue to show deficiencies in their communication with the capital market, and that although this group should pay special attention to investor relations to demonstrate their ability to tap the capital market and to secure the success of their transactions. This view is shared by the issuing houses we surveyed.”

A summary of the survey is available via the website of IR.on AG at https://ir-on.com/en/sme-bonds-2020/.

About IR.on AG

IR.on AG is an independent consulting firm for investor relations and financial communications. The agency assists companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as an interim IR manager, in capital market transactions and special situations such as crises or restructuring exercises, as well as press relations with the financial and business media.

Headquartered in Cologne and Frankfurt am Main, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 400 communication projects, over 300 annual and quarterly reports and over 100 capital market transactions including 33 SME bond issues.

Contact:

IR.on Aktiengesellschaft

Frederic Hilke

T +49 221 9140-970

E info(at)ir-on.com