Share Article

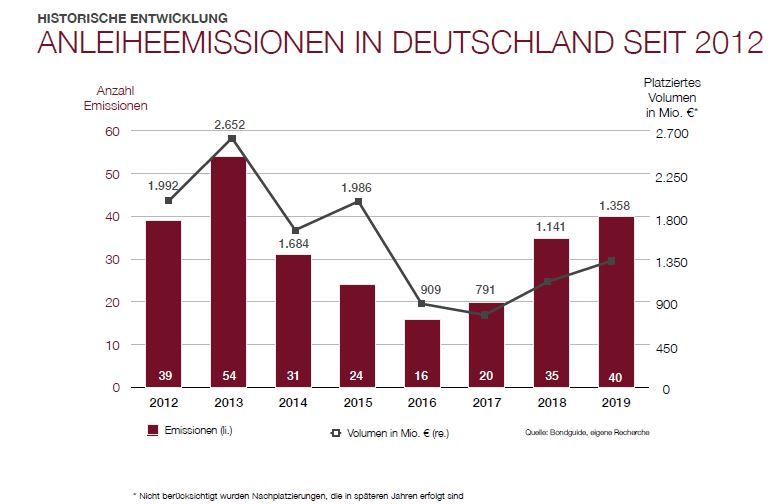

Cologne, 20 January 2020 – The German market for SME bonds again showed a very positive trend in 2019. 35 companies made a total of 40 issues, placing a volume of EUR 1.36 billion (previous year: 35 issues; EUR 1.14 billion). This means that the number of transactions was up by 14% and the volume up by 19% on 2018. Compared to the EUR 1.77 billion target volume of the bond issues, the placement ratio averaged around 77% (previous year: 71%). The average coupon across all transactions increased by 46 basis points to 5.57% p.a. These are the results of a review of the German SME bond market in the past year conducted by investor relations consultancy IR.on AG.

The real estate sector (10 companies; 29% of issuers) was again the dominant sector among the 35 SME bond issuers in 2019. On the whole, however, there is a trend towards greater sector diversity. The growing differentiation suggests that individual sectors are becoming saturated. Financial service providers and investment companies (four issuers each; 11%) share second place, followed by the automotive and commodities sectors (three issuers each; 9%).

Half of the issues were placed in full (20 issues), which means that the percentage of fully placed issues (50%) was on a par with the previous year (49%). Follow-up issues (25 issues; 60% placed in full) were particularly successful, whereas only 33% of the debut bonds were placed in full.

In terms of volume, most of the transactions were in the range of up to EUR 30 million (24 bonds; 60%). Four issues (Katjes International, two S Immo bonds, UBM Development) were between EUR 100 million and EUR 150 million (which, according to the criteria of the study, marks the upper limit of the SME segment).

The maturities of the SME bonds issued in 2019 ranged from four to ten years, with five-year maturities again the most common (25 bonds; 62.5%). Defaults declined once again: while there were three insolvencies in 2018 (volume: EUR 5.2 million), golf equipment supplier Golfino was the only issuer to default in 2019 with a low bond volume of EUR 4 million.

Outlook on 2020: further stabilization of the SME bond market

For the outlook on 2020, IR.on interviewed nine issuing banks that are active in the SME segment. They expect an average of 23 issues in the coming year.

“The forecasts made by the issuing houses are more optimistic than at the beginning of last year (21 issues), but more cautious compared to the actual level reached in 2019,” says Frederic Hilke, a consultant with IR.on AG. “On the whole, bank representatives project a further stabilization and professionalization of the segment.”

As far as interest rates are concerned, all issuing banks expect coupons to remain stable. The real estate sector remains the leading sector, whose super cycle is expected to continue. In the automotive and industrial/capital goods sectors, bank-independent forms of financing will gain importance as a result of the transformation of the industry.

While the choice of stock market segment and credit ratings are of minor importance for the success of a transaction, the majority of the banks surveyed highlight the increasingly critical importance of transparency in the bond market, especially with regard to financial ratios and business models. This is consistent with the trend towards public offerings (82.5%) and fewer private placements observed this year. Consequently, the banks expect public offers to predominate again in 2020.

On the whole, bond issuers’ communication has improved, according to the basic criteria for investor relations examined in the study. “This year again, we analyzed the IR websites of the 40 issuers with regard to fundamental IR information and gave them a transparency score (IR.score),” says Frederic Hilke. “While the average IR.score has improved compared to the previous year, almost one third of the websites (11 issuers) failed to meet the information standards expected by investors, as reflected in a score of 3.5 or lower. Especially first-time issuers have room for improvement in this respect.”

A summary of the survey is available via the website of IR.on AG at https://ir-on.com/en/sme-bonds/.

About IR.on AG

IR.on AG is an independent consulting firm for investor relations and financial communications. The agency assists companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as an interim IR manager, in capital market transactions and special situations such as crises or restructuring exercises, as well as press relations with the financial and business media.

Headquartered in Cologne and Frankfurt am Main, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 300 communication projects, over 180 annual and quarterly reports and around 100 capital market transactions including 30 SME bond issues.

Contact:

IR.on Aktiengesellschaft

Frederic Hilke

T +49 221 9140-970

F +49 221 9140-978

E info@ir-on.com