Share Article

Cologne, 25 July 2024 – In an overall challenging capital market environment, which has been characterised by geopolitical and macroeconomic resistance in many respects in recent years, the German SME bond market showed clear signs of recovery in the first half of 2024 in line with the international high-yield bond markets and proved to be more receptive than a year earlier due to a sharp increase in placement volumes. These are the findings of an analysis of the first half of 2024 on the German SME bond market conducted by investor relations consultancy IR.on AG.

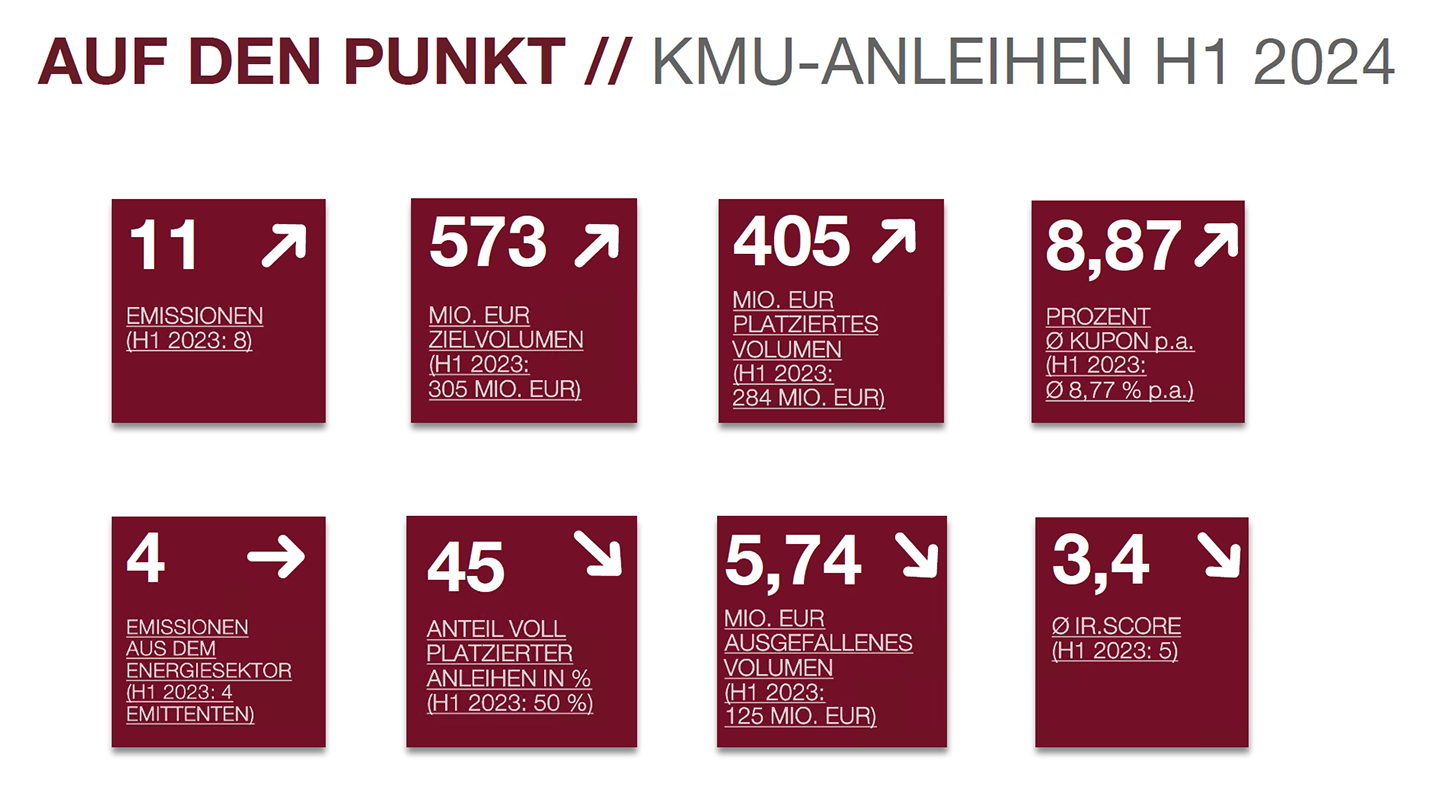

Compared to the same period of the previous year, the number of SME bond issues increased in the first half of 2024. A total of 11 bonds were issued by 11 issuers (H1 2023: 8 bonds from 8 issuers). The volume placed increased by 43% to around EUR 405 million (H1 2023: EUR 283.5 million). Measured against the target volume of bond issues totalling EUR 573 million, the placement ratio is down year-on-year at around 71% (H1 2023: 93%). The main reason for this is that no information was provided on the volume placed for two bonds with an issue volume totalling EUR 150 million. Adjusted for these issues, the placement rate was just under 96%.

At 8.87%, the average annual coupon was ten basis points above the previous year's level (H1 2023: 8.77%) and 23 basis points above the average coupon for 2023 as a whole (8.64%). In view of the interest rate turnaround that has been heralded, the peak on the SME bond market is also expected to be reached in 2024.

For the third time in a row, issuers from the energy sector are again the most frequently represented in the first half of 2024. Once again, a total of four companies (36%) can be attributed to this sector, followed by two issuers each from the financial services and consumer staples sectors. One issuer each from the real estate, industrial goods & services and technology sectors was represented.

With five full placements (45%), the value of fully subscribed bonds is slightly below the previous year's level (H1 2023: four full placements, 50%). Unlike in the same period of the previous year, follow-up issues (6) only slightly outnumbered first-time issues (5) of SME bonds. As in the previous year, the majority of issues were accompanied by issuing houses or banks (7 bonds, 64%), including Pareto Securities with the most transactions (4 issues). Only 4 transactions were carried out in the form of an own issue (36%).

Frederic Hilke, Senior Consultant and Head of IR Consulting at IR.on AG: "The significant increase in the placement volume of SME bonds in a generally challenging and volatile capital market environment emphasises the strength of capital market-oriented SMEs. After a long phase of stagnating interest rates and a now even declining interest rate level, bonds will continue to be an attractive financing option in the future. The market proved to be receptive in the first half of the year - also for first-time issues."

Compared to the previous year, the number of restructurings fell slightly (H1 2024: 5 issuers, H1 2023: 6 issuers), although the bond volume affected by this is higher than the previous year's figure (H1 2024: EUR 282 million, H1 2023: EUR 196 million). Two SME bonds defaulted in the first half of 2024; the volume affected totalled EUR 5.74 million and was therefore significantly lower than the figure for the first half of 2023 (EUR 125 million).

At the beginning of the year, IR.on AG asked nine issuing houses active in the SME segment for their assessment for 2024 as a whole. With an average of 22 transactions, they expected issuing activity to remain at the previous year's level. This expectation appears realistic in the context of the developments in the first half of 2024.

Frederic Hilke: "After consistently awarding top marks to SME bond issuers last year, this high level was not confirmed in the first half of 2024. The overall average IR.score was a solid 3.41 points. The main reason for this is likely to be the higher number of first-time issues and the associated inexperience with regard to transparency requirements. In addition, two issuers did not provide any accessible information, which also had a negative impact. In addition, there were significantly more private placements in the first half of 2024, which naturally provided less publicly accessible information."

A summary of the survey is available on the IR.on AG website at https://ir-on.com/en/sme-bonds/ (German only).

IR.on AG is an independent consulting firm for investor relations, financial and sustainability communications. The IR.on AG team assists companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as interim IR managers, in capital market transactions and special situations such as crises or restructurings, as well as in press relations with the financial and business media. IR.on also advises companies on the development and implementation of ESG/sustainability strategies and the preparation of sustainability reports. Headquartered in Cologne and Frankfurt am Main, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 400 communication projects, over 300 financial and sustainability reports and over 100 capital market transactions, including more than 40 SME bond issues.

IR.on Aktiengesellschaft

Mittelstr. 12-14, House A

50672 Cologne

T +49 221 9140-970

E info@ir-on.com

http://www.ir-on.com