Share Article

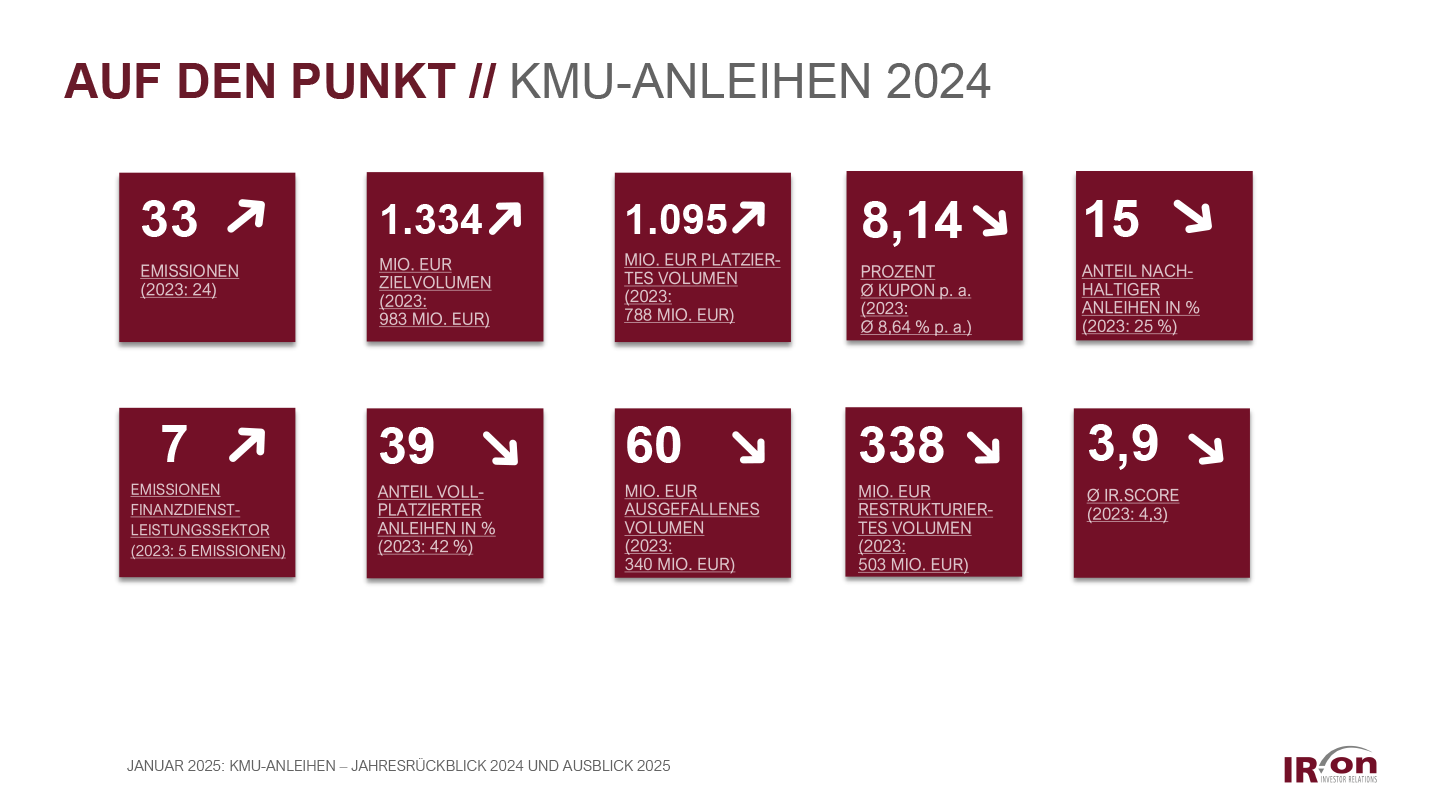

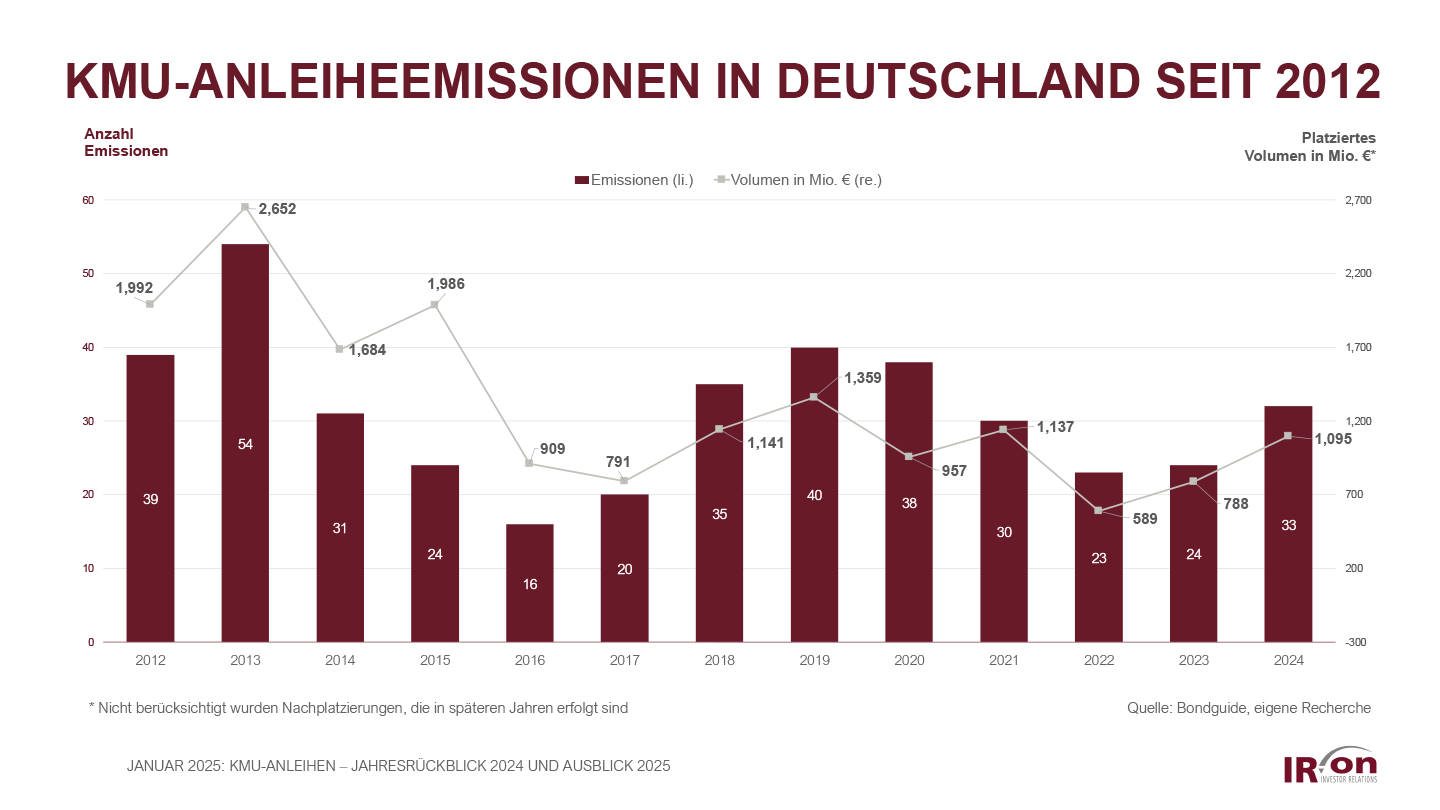

Cologne, 21 January 2025 – The German market for SME bonds continued its recovery in 2024. The number of issues rose by more than a third to 33, while the volume placed with investors increased by around 39%. As expected, the average annual coupon fell significantly by 50 basis points to 8.14% (2023: 8.64%) as a result of the lower interest rate level.

In 2024, a total of 33 SME bonds (2023: 24 bonds) were issued by 28 companies with a target volume of EUR 1.33 billion. The volume placed rose to EUR 1.10 billion (2023: EUR 788 million), which corresponds to a placement rate of 82% (2023: 80%). These are the findings of an annual review of the German SME bond market conducted by investor relations consultancy IR.on AG.

Of the 33 issues, 20 were follow-up issues and 13 were debut bonds. The proportion of sustainable bonds surveyed as part of the study was 15% with 5 bonds (2023: 25%; 6 bonds). The volume of defaults fell drastically by 82% to around EUR 60 million, the lowest level since the beginning of the coronavirus pandemic in 2020. At EUR 338 million, the restructuring volume was also significantly below the previous year's level (2023: EUR 503 million).

Frederic Hilke, Senior Consultant and Head of IR Consulting at IR.on AG: “The German market for SME bonds continued to recover in 2024 and recorded a significant increase in the number of issues carried out. There was a significant increase in the placement volume and a slight improvement in the placement ratio compared to the previous year. The renewed discrepancy between own issues and bank-backed issues is particularly striking. While own issues only had a placement rate of 58% in 2024, this figure was 90% for bank-backed issues. The decline in the volume of defaulted bonds as well as the lower restructuring volume illustrate the stabilisation of the SME bond market.”

The 33 bonds issued by the 28 SME bond issuers were spread across seven different sectors in 2024. While the energy sector has been the leading sector for SME bonds in recent years, the financial services sector was the most active in 2024 with seven issues. The energy, industrial goods and services and chemicals sectors were in joint second place this year with six issues each.

The follow-up issues (20) carried out in 2024 recorded a very strong placement ratio (100.2%) due to numerous full placements and tap issues. The placement ratio of the debut issues whose placement results were published also improved from 28% in the previous year to an average of 41%. No placement results were published for 5 first-time issues, which generally indicates low placement ratios.

There was a significant recovery in bond defaults due to a much lower number of large-volume defaults compared to the previous year. While the default volume in 2023 was still EUR 340 million (7 bonds from 4 issuers), the figure in 2024 was just EUR 60 million (5 bonds from 5 issuers). Bonds from AOC | Die Stadtentwickler GmbH, B4H Brennzstoffzelle4Home GmbH, Schlote Holding GmbH, Solarnative GmbH and Verianos SE were affected.

The number of bonds affected by restructuring was slightly above previous year's level with twelve bonds (2023: 10 bonds), while the total restructuring volume affected fell significantly to EUR 338 million (2023: EUR 503 million).

In view of the growing importance of green bonds, social bonds and similar ESG-related bonds, all SME bonds that comply with an ICMA standard (GBP, SBP, SLBP) or a comparable standard and for which a rating and/or an SPO (second party opinion) is available were surveyed for the second time after 2023 in the 2024 full-year study.

In 2024, five sustainable SME bonds were identified, the majority of which had an SPO of imug rating (3 out of 5 bonds). At 7.68%, the average annual coupon was below the average interest rate of all SME bonds (8.14%). With a placement volume of EUR 178.7 million and a target volume of EUR 295.0 million in 2024, the identified green bonds had a placement rate of 61%, which was below the average issuer’s placement rate for this year (82%).

IR.on AG surveyed ten banks and issuing houses active in the SME segment regarding the outlook for 2025. On average, they expect 27 issues for the current year with stable interest coupons overall. The main reasons for this year's rather conservative, albeit more optimistic forecast are the continuing challenging economic environment and the prevailing political uncertainties. At the same time, some issuing houses expect that the further narrowing of credit spreads could boost issuing activity on the SME bond market.

Frederic Hilke: “For 2025, the banks expect a slight decline in issuing activity on the SME bond market, which is mainly due to continued weak macroeconomic development in Germany. In addition, the upcoming general election and the change of government in the USA are cited as significant political uncertainty factors. The institutes believe that the energy sector in particular will play a key role and potentially stimulate demand on the market. An increase in the proportion of sustainable bonds, a further rise in the importance of transparency requirements and stricter covenants are also forecast. As a result, a further increase in issues in the Nordic bond format is also expected by some market participants. Overall, stability and trust are increasingly important for investors in the SME bond market.”

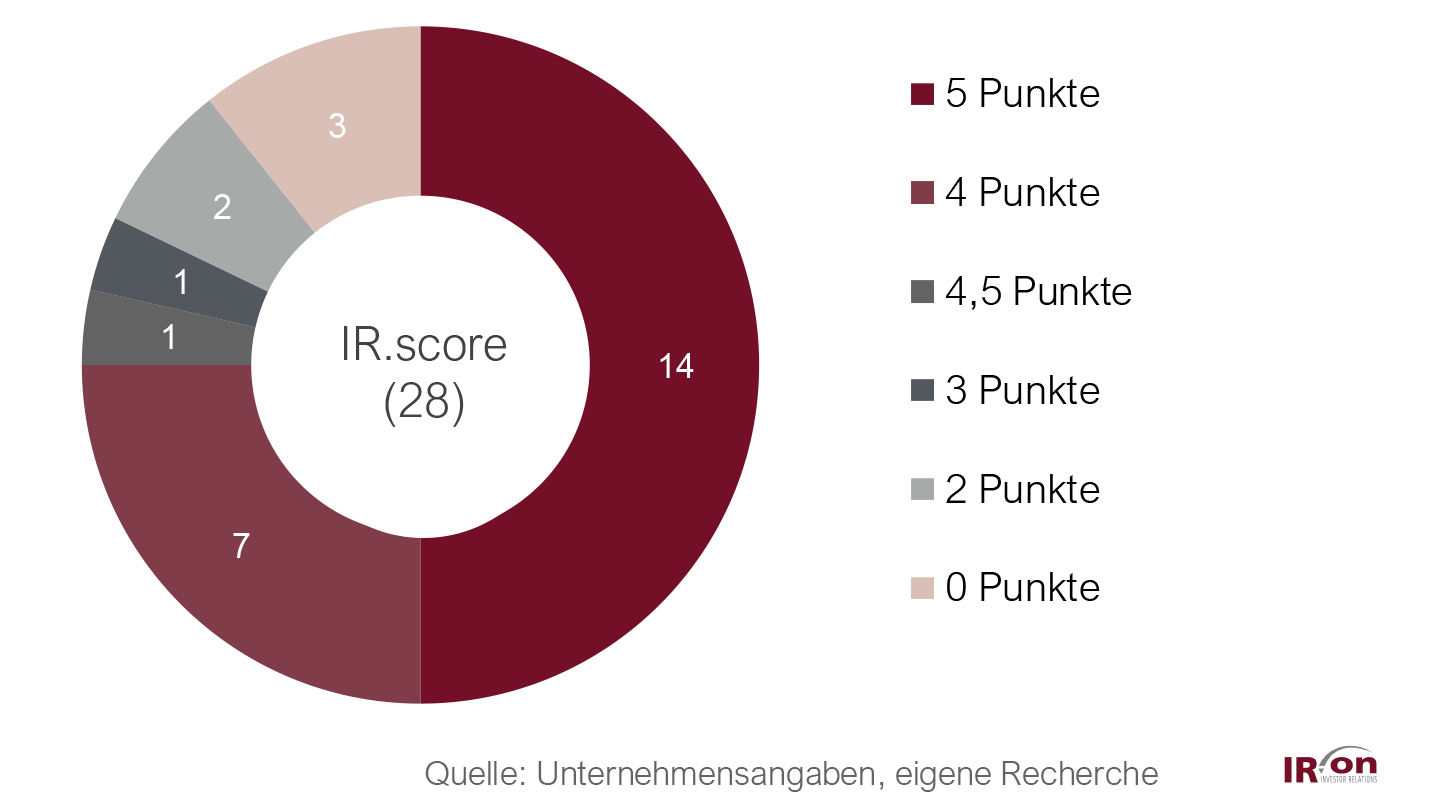

In this year's review of the IR websites of the 28 issuers with regard to basic IR information, the average transparency index ‘IR.score’ was 3.9 points (out of a maximum of 5 points) after 4.3 points in the previous year. The average IR.score has therefore deteriorated compared to the previous year. This development is also a result of the significantly higher number of initial bond offerings compared to the previous year (2024: 12/32 (38%); 2023: 5/24 (21%)) and the associated lack of experience of issuers with regard to IR communication and transparency requirements, as the investor relations work analysed in the study shows.

A summary of the survey is available on the IR.on AG website at https://ir-on.com/en/sme-bonds/.

Consultants Frederic Hilke and Robin Terrana played a leading role in analyzing and evaluating this year's SME bond study.

IR.on AG is an independent consulting firm for investor relations, financial and sustainability communications. The IR.on AG team assists companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as interim IR managers, in capital market transactions and special situations such as crises or restructurings, as well as in press relations with the financial and business media. IR.on also advises companies on the development and implementation of ESG/sustainability strategies and the preparation of sustainability reports. Headquartered in Cologne, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 400 communication projects, over 300 financial and sustainability reports and over 100 capital market transactions, including more than 40 SME bond issues.

IR.on Aktiengesellschaft

Frederic Hilke, Robin Terrana

Mittelstr. 12-14, House A

50672 Cologne

Phone: +49 221 9140-970

Email: info@ir-on.com

www.ir-on.com