Share Article

Cologne, 19 July 2023 - The geopolitical and macroeconomic challenges of the recent past have noticeably affected the global economy. The rise in interest rates in recent months is now also having a noticeable impact on the German SME bond market in the form of sharply increased coupons.

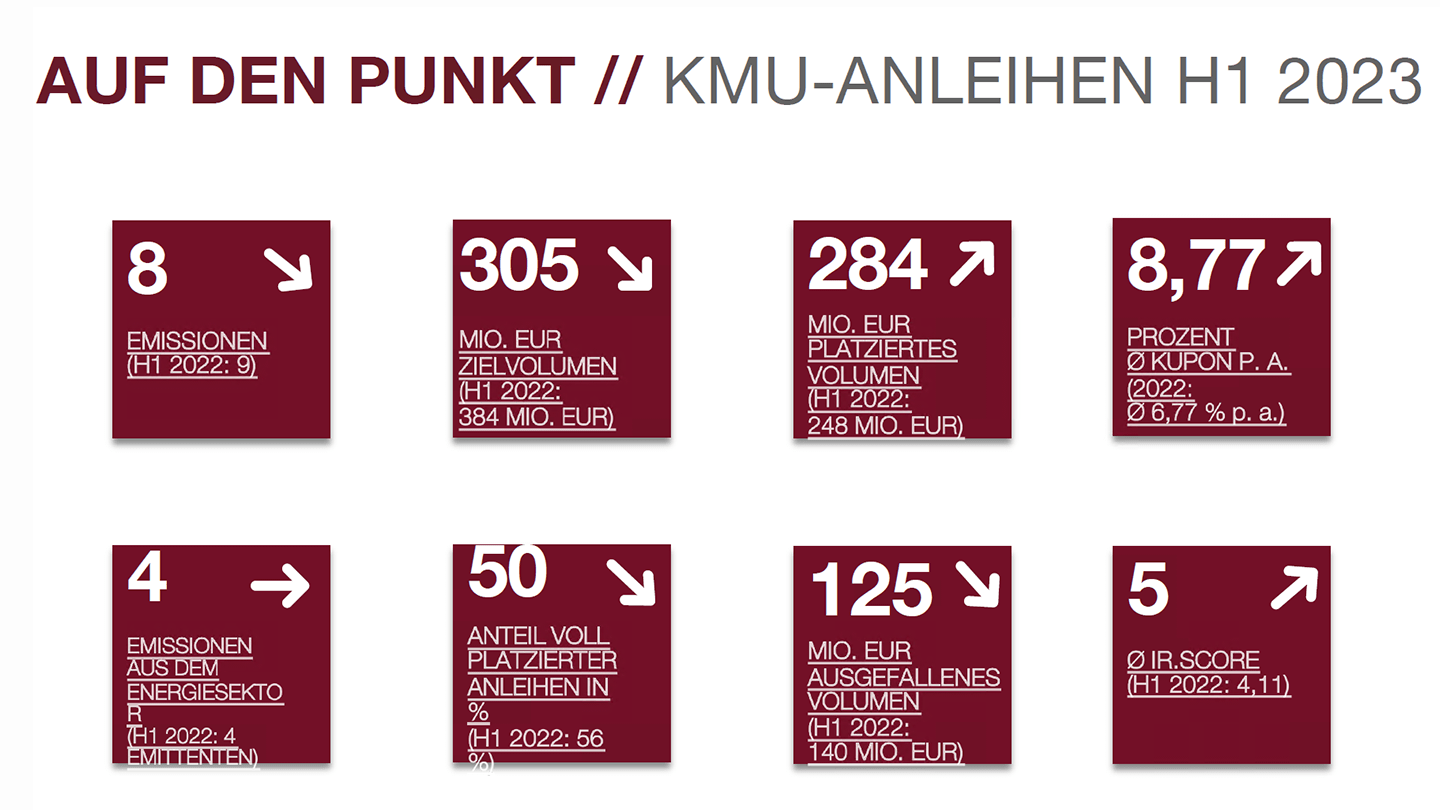

Compared with the prior-year period, the number of SME bond issues decreased slightly in the first half of H1 2023. A total of 8 bonds were issued by 8 issuers (H1 2022: 9 bonds by 9 issuers). In contrast, the volume placed in the process increased by 14.5% to EUR 283.5 million (H1 2022: EUR 247.6 million). Measured against the target volume of bond issues of 305 million euros, this results in a significantly higher placement ratio of around 92.9% compared with the previous year (H1 2022: 65%). As a result of higher interest rates, the average coupon of the bonds issued increased significantly to 8.77% p.a. (2022: 6.77 %). This is the result of an analysis of the first six months of 2023 on the German SME bond market conducted by investor relations consultancy IR.on AG.

By comparison, the German IPO market recorded significantly lower issuing activity with only one IPO (IONOS Group SE) with a volume of 447 million euros.

As in the prior-year period, issuers from the energy sector are the most frequently represented in the first half of 2023. Once again, a total of 4 companies (50%) can be assigned to this sector, followed by one issuer each from the real estate sector, asset management, industrial goods and services, and travel & leisure. With four full placements (50%), the number of fully subscribed bonds is slightly below the previous year's level (H1 2022: five full placements, 56%). In addition, as in the prior-year period, follow-up issues (7) significantly outweigh initial issues (1) of SME bonds in H1 2023. Unlike in the first half of 2022, the majority of the issues were accompanied by banking institutions (5 bonds, 62.5%), while only three bonds (37.5%) were issued in the form of an own issue.

Frederic Hilke, Senior Consultant and Head of IR Consulting at IR.on AG: "Despite the challenging capital market environment, we saw a number of successful issues in the first half of the year, primarily refinancing transactions or follow-up issues from established issuers. Thus, the SME bond market has at least held its ground at a low level and remains a valid financing alternative for medium-sized companies."

The majority of the transactions were in the range of an issue volume of up to 50 million euros (7 bonds, 87.5%). Only one of the bonds issued had a larger volume, exceeding the EUR 100 million mark. The maturities of all SME bonds issued in the first half of 2023 range between three and six years, with the majority having a five-year maturity (five bonds, 62.5%). The macroeconomic uncertainties and the continuous rise in interest rates in line with the interest rate increases by central banks are making themselves felt on the bond market in the first half of 2023. Compared to the previous year, the number of restructurings increased significantly (H1 2023: 9 issuers, H1 2022: 2 issuers), although the bond volume affected by this is lower than in the previous year (H1 2023: EUR 196 million, H1 2022: EUR 228 million). Only one SME bond defaulted in the first half of 2023.

At the beginning of the year, IR.on AG asked eight issuing houses active in the SME segment for their assessment of 2023 as a whole, with them expecting issuing activity on a par with the previous year at an average of 22 transactions. This expectation appears optimistic in the context of a challenging capital market environment and the fact that at the end of the first half of 2022, with eight issues, less than half the forecast number of transactions had taken place. However, the start of several bond issues in the middle of the year, which are expected to be completed in July 2023, remains an indication that the market is picking up.

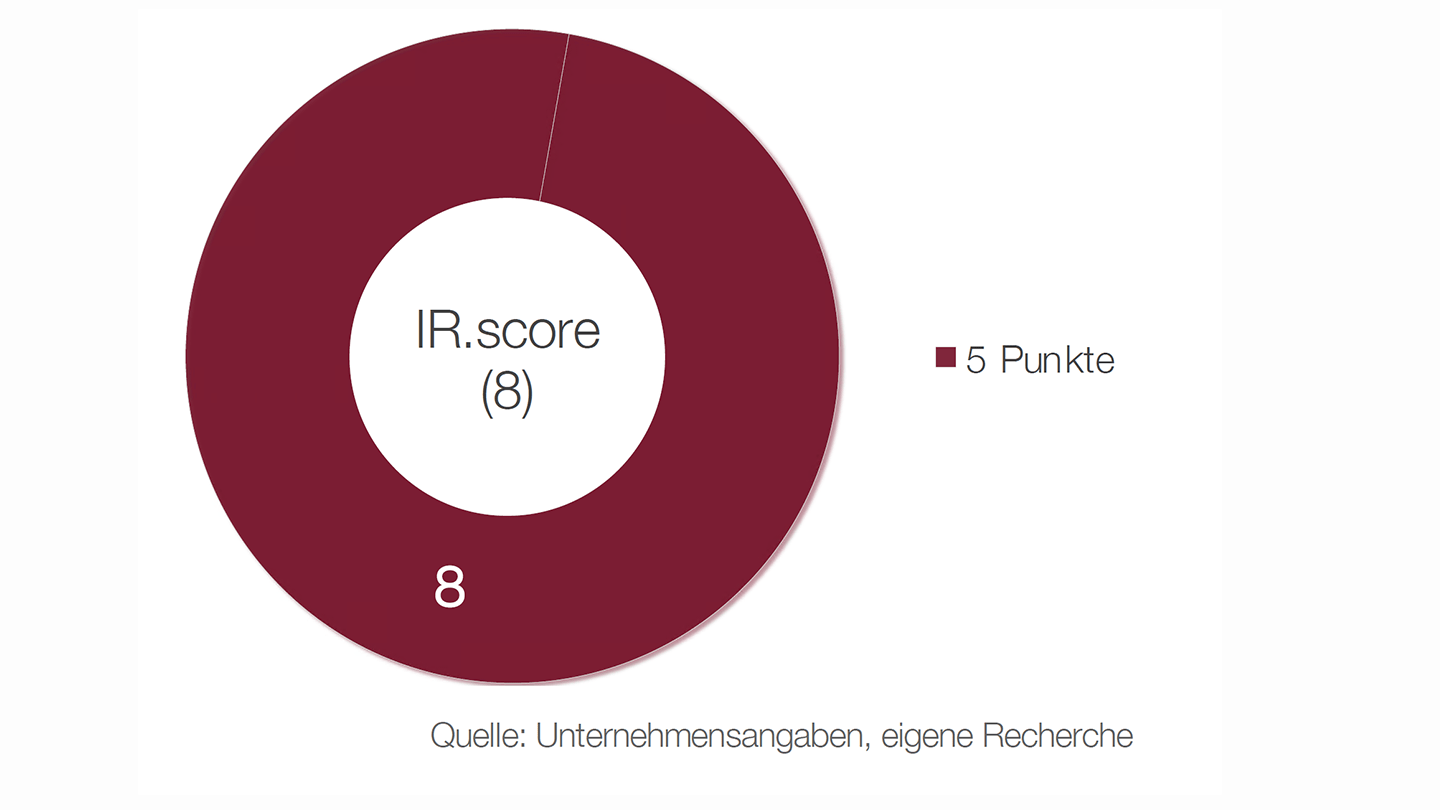

IR.score: Top scores for SME bond issuers in the first half of 2023

Frederic Hilke: "The examination of the IR websites of all eight SME bond issuers has shown that the positive trend from the previous year continues in terms of investor communication as measured by our transparency index "IR.score" (scale from 0 to 5 points). In the first half of 2023, all issuers were able to achieve the full score for the first time (IR.score: 5), including seven out of eight follow-up issuers and three listed companies."

A summary of the survey is available on the IR.on AG website at https://ir-on.com/en/sme-bonds/.

About IR.on AG

IR.on AG is an independent consulting firm for investor relations, financial and sustainability communications. In the IR segment, IR.on supports companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as an interim IR manager, in capital market transactions and special situations such as crises or restructuring exercises, as well as press relations with the financial and business media. Headquartered in Cologne and Frankfurt am Main, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 400 communication projects, 300 annual and quarterly reports and more than100 capital market transactions including 40 SME bond issues.

Contact

IR.on AG

Mittelstr. 12-14, House A

50672 Cologne

T +49 221 9140-970

E info@ir-on.com

ir-on.com/en/