Share Article

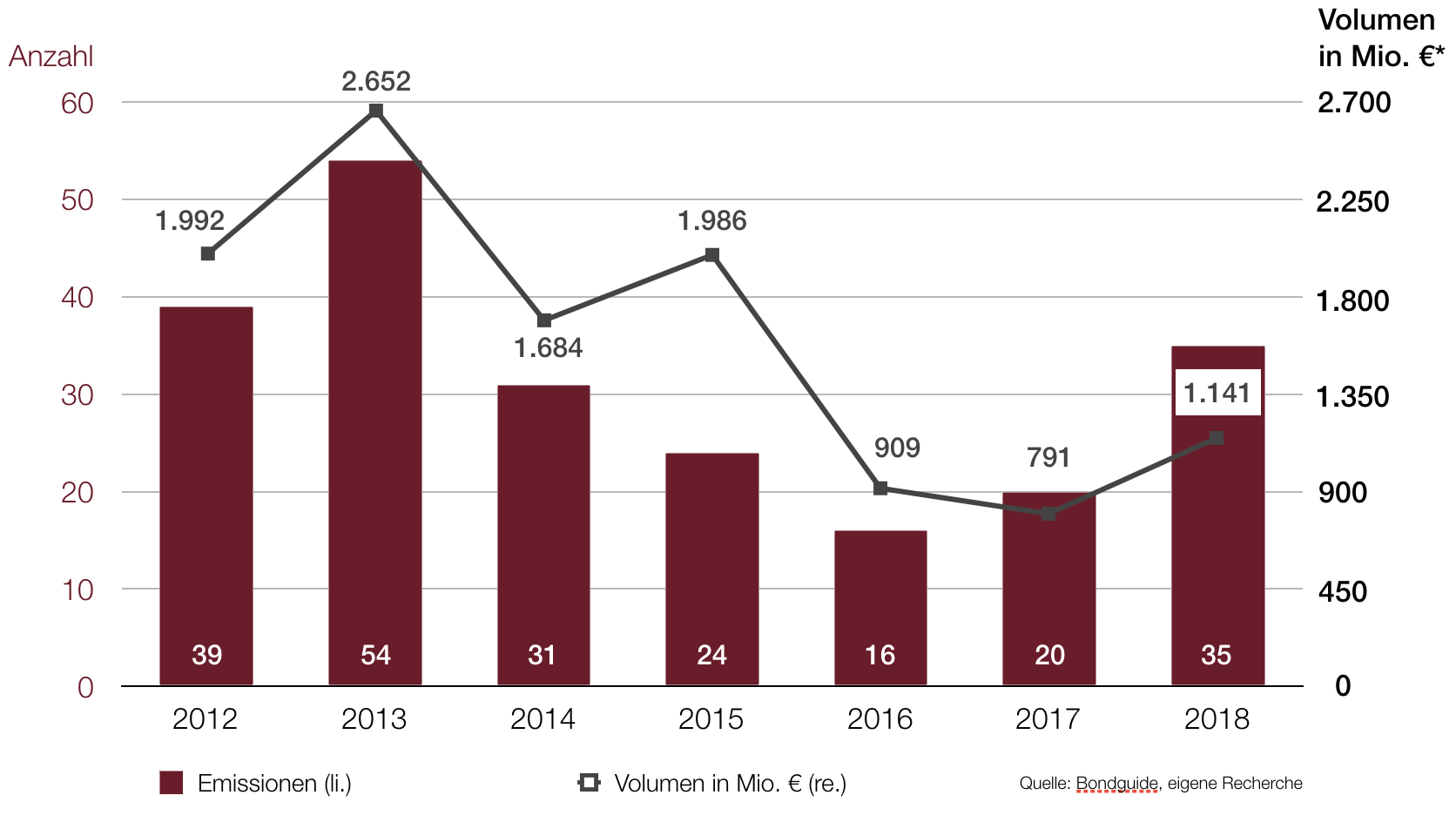

Cologne, 11 January 2019 – The German market for SME bonds showed a clearly positive trend in 2018. 30 companies placed an amount of EUR 1.14 billion in a total of 35 issues (previous year: 20 issues; EUR 791 million). This means that the number of transactions and the volume placed were up by 75% and 44%, respectively, on 2017. Compared to the target volume of EUR 1.62 billion, this resulted in a placement ration of 71% (previous year: 93%). The coupon declined by an average of 52 basis points across all transactions to 5.11%. These are the results of a review of the German SME bond market in 2018 conducted by investor relations consultancy IR.on AG.

The clearly dominant sector among the 30 SME bond issuers in 2018 was again the real estate sector (13 companies; 43 %), many of whose players opted for a bond issue in view of high investor demand and favorable interest rates. Financial service providers and investment firms came in second place (four issuers; 13%), followed by the renewable energy sector (three issuers; 10%).

Close to half of the issues were fully placed (17 issues), while two bonds are still in the placement phase and four bond issuers disclosed no information on the amount placed. Capital market experience is a key factor for a successful issue; this is reflected in the fact that the full placement ratio of listed issuers, at 75%, is almost twice as high as that of new entrants to the capital market (38%). Most of the transactions amounted to between EUR 10 and 30 million (13 bonds), while three issues (Accentro Real Estate, Ferratum and S Immo) had a volume of EUR 100 million; DIS Asset’s issue was the largest at EUR 150 million (which is the upper limit of the SME segment according to the criteria applied for the study).

Most of the issues again had a maturity of five years (18 bonds; 51%). The number of defaults declined even further, namely from eight in 2017 to three in 2018. The number of insolvencies dropped from four to two (mybet Holding, Royal Beach), and the defaulted amount fell sharply from EUR 832 million to EUR 5.2 million.

Outlook on 2019: Segment expected to become further established

For its outlook on 2019, IR.on interviewed nine issuing houses that are active in the SME segment. They expect an average of 21 issues for the coming year.

“The issuing houses we interviewed are more optimistic in their forecasts than at the beginning of last year (15 issues) but more cautious compared to the actual number of issues in 2018. While this reflects the fact that the segment is becoming further established, it also shows that there is quite some uncertainty, mainly because of the volatile capital market environment,” says Florian Kirchmann, Senior Consultant at IR.on AG.

As far as interest rates are concerned, the majority of the issuing houses expects coupons to remain stable or increase slightly. Real estate will remain the dominant sector. According to the bank representatives, ratings and the choice of the stock exchange segment play only a minor role for the success of an issue. Nearly all houses agree that the segment is becoming increasingly professional.

The basic criteria for investor relations activities examined by the study show that there is still room for improvement where communication is concerned. “We have analyzed the IR websites of the 30 issuers with regard to fundamental IR information and given them a transparency score (“IR.score”),” says Florian Kirchmann. “More than one third of the websites (11 issuers) reached a score of 3.5 or lower, which means that they do not meet the information standards expected by investors; nine of them were new entrants to the capital market.”

A summary of the survey is available via the website of IR.on AG at https://ir-on.com/sme-bonds/.