Share Article

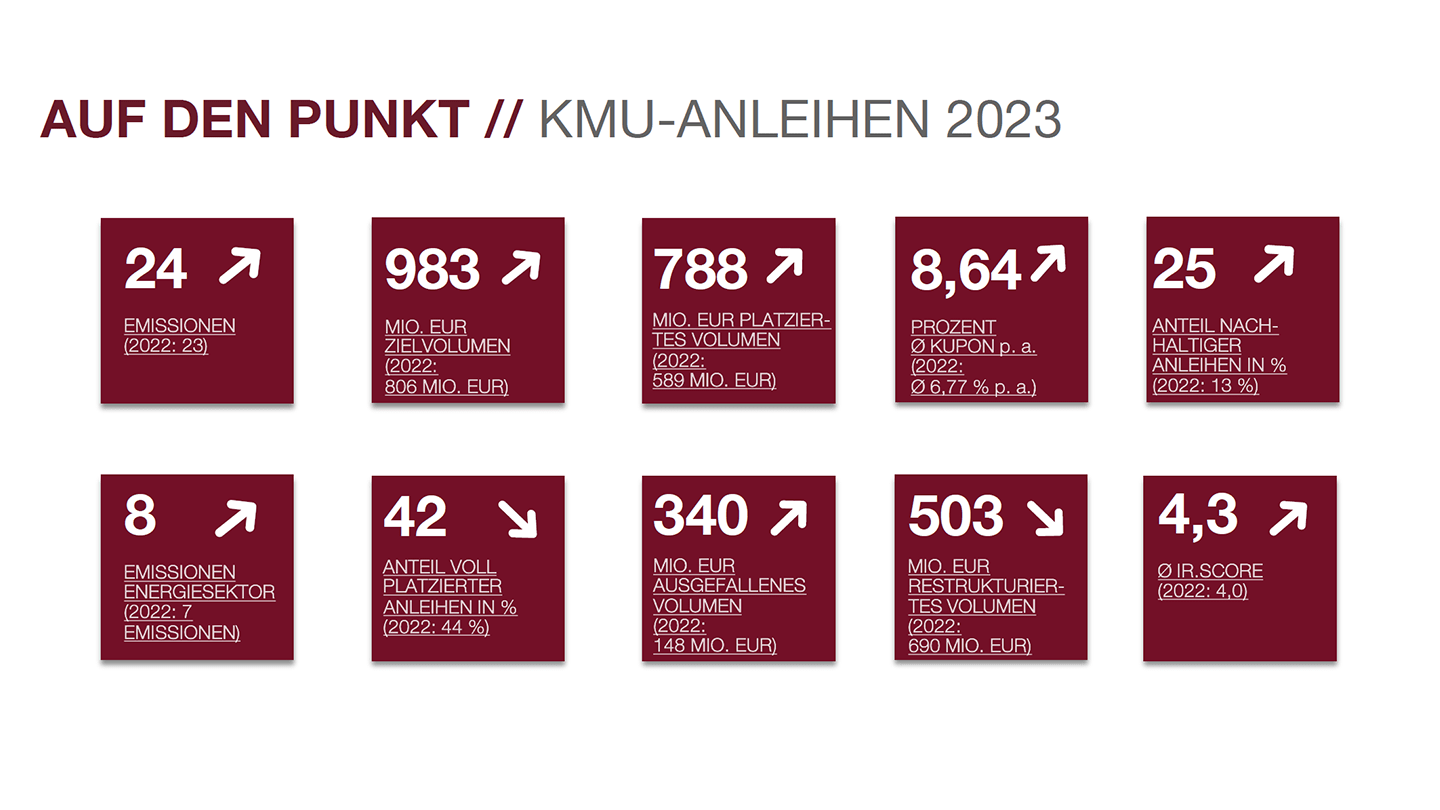

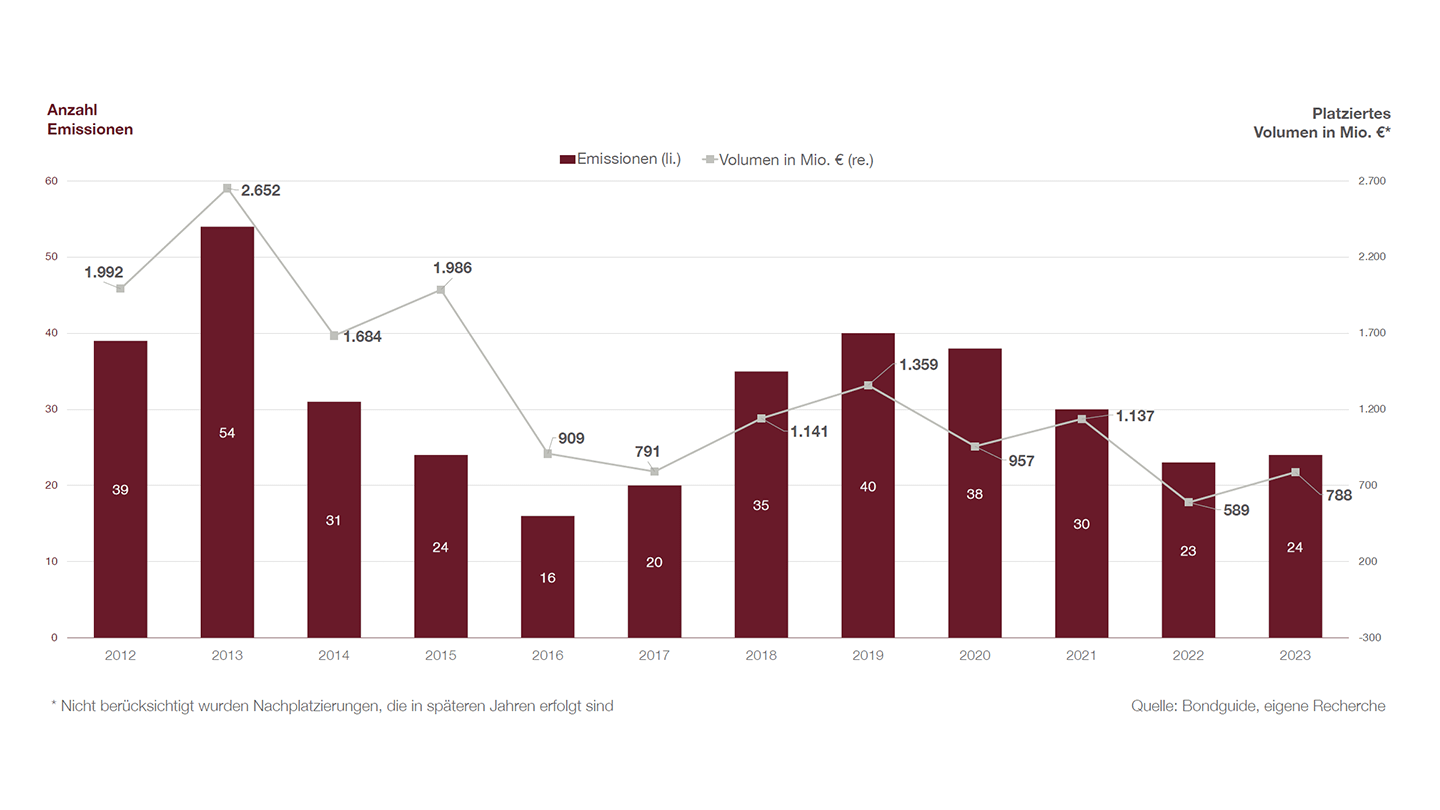

Cologne, 23 January 2024 – The German market for SME bonds recovered slightly in 2023 despite significantly higher coupons. The number of issues was on a par with the previous year, while the volume placed with investors increased by just over a third. As expected, the average annual coupon rose by almost 190 basis points to 8.64% (2022: 6.77%) due to the higher interest rates.

A total of 24 (2022: 23) SME bonds with a target volume of EUR 983 million were issued by 23 companies, including many established issuers in the segment such as family-owned HÖRMANN Industries GmbH or investment holding company Katjes International. The volume placed increased by 34% to EUR 788 million, representing a placement ratio of almost 80%.

Of the 24 issues, 19 were follow-up issues and only five were first-time issues. The share of sustainable bonds, which was determined for the first time, was 25%. The volume of defaults – caused by four insolvencies, including fashion company Gerry Weber and real estate developer Euroboden – rose to EUR 340 million (2022: EUR 148 million). These are the results of a review of the German SME bond market in the past year conducted by investor relations consultancy IR.on AG.

Frederic Hilke, Senior Consultant and Head of IR Consulting at IR.on AG: “Despite the sharp rise in interest rates and the resulting significantly higher coupons, the SME bond market has held its ground at a low level. In particular, the successful follow-up issues by established issuers are an important indicator that the market is still receptive and remains an established financing channel for small and medium-sized enterprises in times of restrictive lending. New issuers either avoided the market or found it difficult in the face of increased risk premiums.”

Issuance activity dominated by the energy sector

As in the previous year, the 24 SME bonds issued in 2023 by 23 companies were spread across eight different sectors. The energy sector again dominated the primary market for SME bonds. Companies from this sector issues a total of eight bonds, followed by financial services (five issues) and real estate (four issues).

The 19 follow-up issues made in 2023 recorded a solid placement ratio of 89%. In contrast, two of the five new issues achieved an average placement ratio of only 28%. No placement results were published for the other three new issues, suggesting that the placement ratio was very low.

In terms of type of placement, public offers continued to dominate, accounting for an unchanged 83% of issues. This reflects issuers’ desire for placement certainty in a difficult market environment, which is enhanced by public offerings.

Defaults also increased in the SME bond market, reflecting a generally higher insolvency rate in Germany. The total volume of defaulted bonds in 2023 was EUR 340 million in (2022: EUR 148 million) and related to bonds issued by Euroboden, the EVAN Group, Gerry Weber and PlusPlus Capital Financial. The latter filed for insolvency only shortly before the end of the year.

The number of bonds affected by restructuring (e.g. maturity extensions, interest rate adjustments) was ten, which was on a par with the previous year’s nine bonds, while the total volume decreased to EUR 503. million (2022: EUR 690 million). Overall, the bond defaults and restructurings reflected the limited refinancing opportunities in the market as well as the crisis in the real estate market.

Sustainable SME bonds

Given the growing number and importance of green bonds, social bonds and similar ESG-related bonds in the SME bond market, the 2023 full-year study also includes for the first time a separate overview of all SME bonds that comply with an ICMA standard (GBP, SBP, SLBP) or comparable standard and for which a rating and/or second party opinion (SPO) is available.

For the full year 2023, six sustainable bonds were identified, the majority of which had an SPO from imug rating (four out of six bonds). The average annual coupon of 8.00% was below the average coupon of all SME bonds (8.64%).

Forecast for 2024: Coupons and issuance activity at prior year level

IR.on AG interviewed nine issuing houses active in the SME segment for its forecast for 2024. They expect an average of 22 issues for the current year. The main reasons for the cautious forecast are the continuing challenges for issuers from the real estate sector and the stagnation of coupons at a high level.

“Issuing houses remain as cautious as ever when it comes to their issuance forecasts,” says Frederic Hilke. “Upcoming refinancings and the large amounts of capital still needed in many sectors to manage the green transformation are seen as the main drivers. This is consistent with the expectation that the energy sector will continue to dominate issuance.”

Coupon expectations are mixed. Four of the nine respondents expect coupons to remain unchanged in 2024. Three issuing houses expect coupons to fall, while the other two expect coupons to rise.

In terms of trends, the majority of the issuing houses expect transparency requirements to continue to increase. The increasingly important Nordic Bond format is setting trends in this respect also for traditional German issues. Moreover, banks expect sustainability-related topics to play an increasingly important role. Seven of the nine issuing houses assume that sustainable bonds will account for at least 30% in 2024.

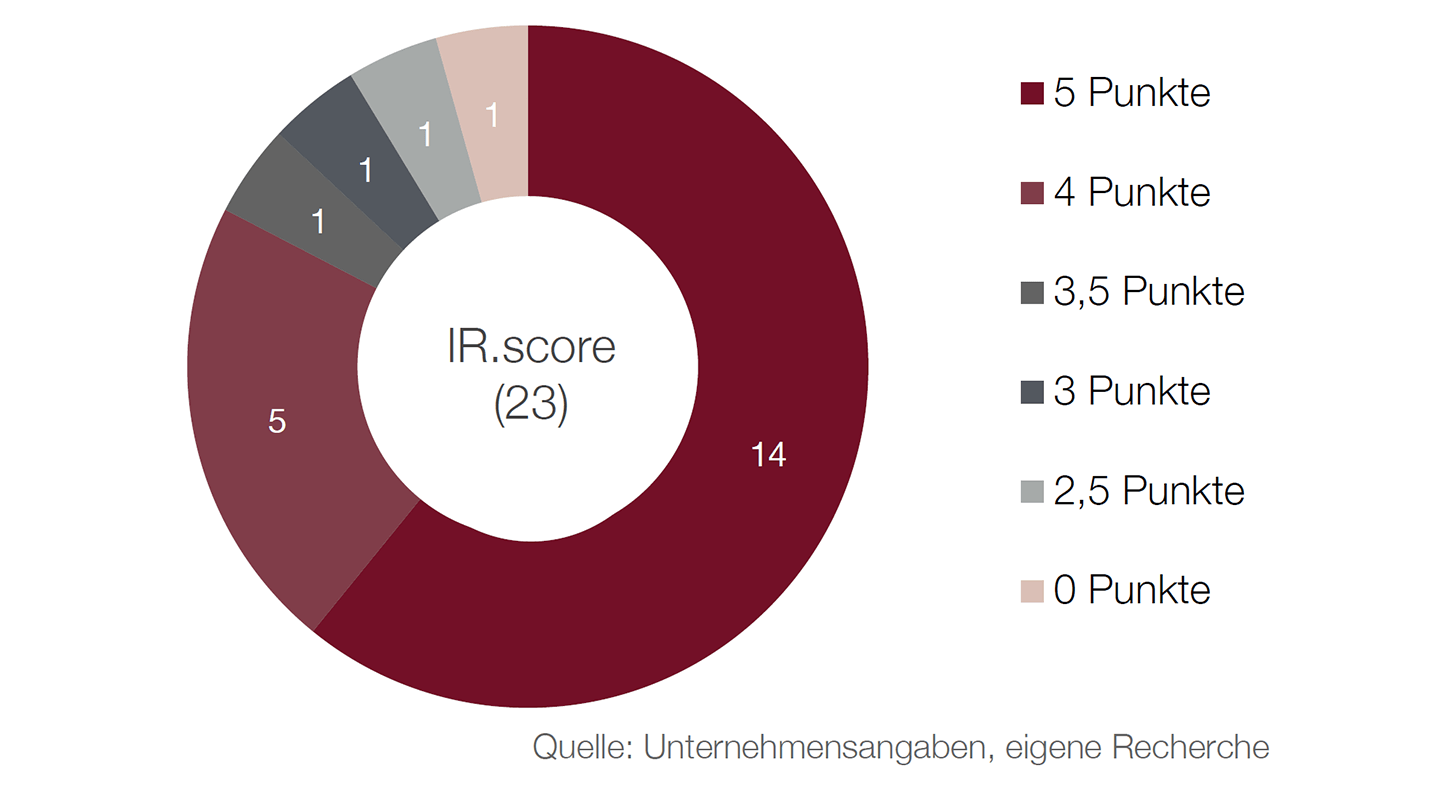

IR.score of 4.3 points higher than prior year

Overall, bond issuers’ communications in 2023 showed an extremely solid level of transparency, judging by the investor relations activities reviewed in the study. In this year’s review of the IR websites of the 23 issuers for basic IR information, the average “IR.score” transparency index was 4.3 points (out of a maximum of 5 points), compared to 4.0 points in the previous year.

A summary of the survey is available via the website of IR.on AG at https://ir-on.com/en/sme-bonds/.

About IR.on AG

IR.on AG is an independent consulting firm for investor relations, financial and sustainability communications. The IR.on AG team assists companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as interim IR managers, in capital market transactions and special situations such as crises or restructurings, as well as in press relations with the financial and business media. IR.on also advises companies on the development and implementation of ESG/sustainability strategies and the preparation of sustainability reports. Headquartered in Cologne and Frankfurt am Main, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 400 communication projects, over 300 financial and sustainability reports and over 100 capital market transactions, including 40 SME bond issues.

Contact

IR.on Aktiengesellschaft

Frederic Hilke

Mittelstr. 12-14, Haus A

50672 Köln

T +49 221 9140-970

E info@ir-on.com

www.ir-on.com