Share Article

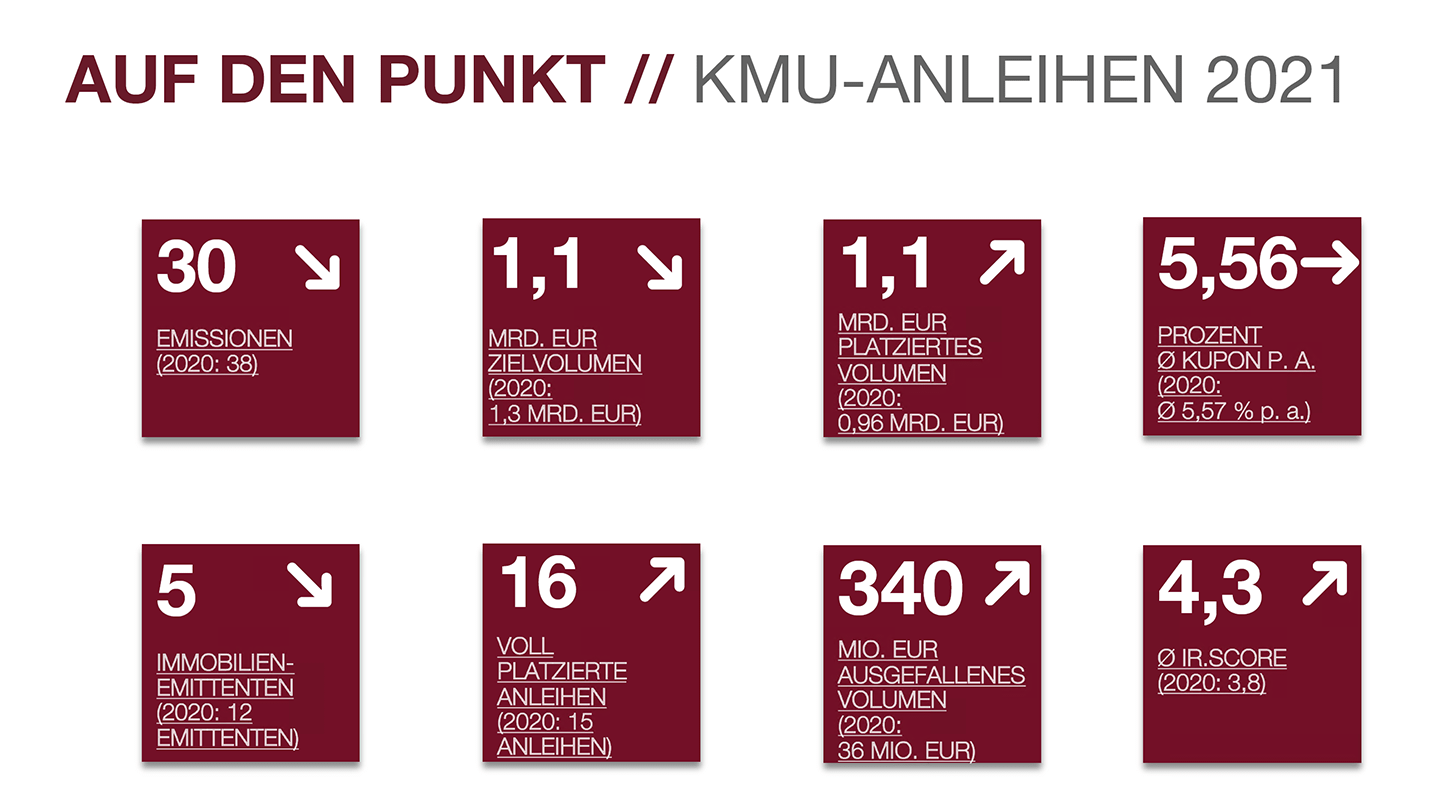

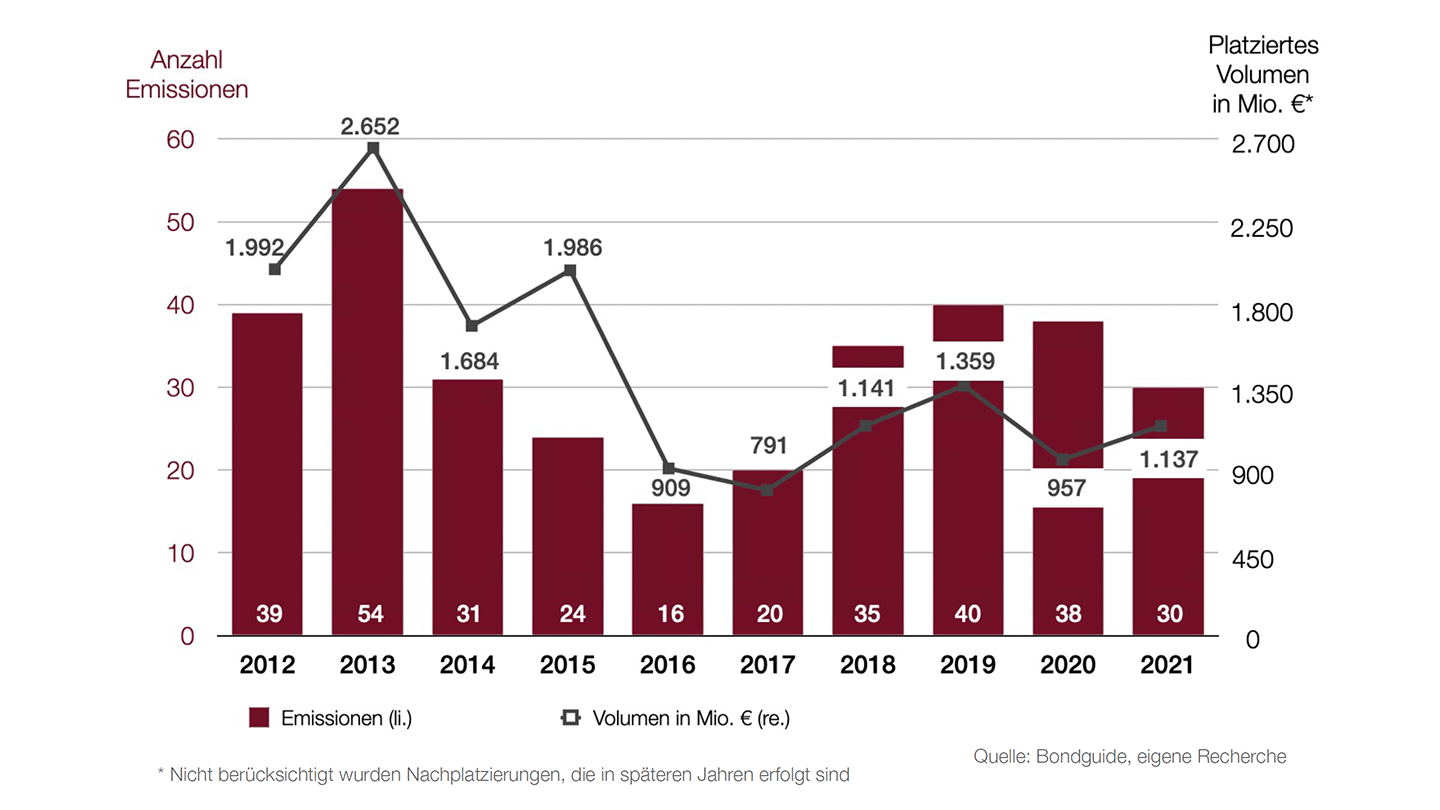

Cologne, 21 January 2022 – While the year 2021 was dominated by COVID-19 also on the German SME bond market, signs of recovery became apparent in some aspects. Although the number of issues declined again, the volume placed increased by 19% to EUR 1.137 billion.

A total of 30 SME bonds (2020: 38 bonds) with a target volume of EUR 1.140 billion were placed by 26 issuers. The volume placed rose from EUR 0.957 billion in the previous year to EUR 1.137 billion, leading to an exceptionally high placement ratio. Last year’s figures include a high top-up volume of EUR 157.8 million of bonds that were in particularly high demand. Adjusted for these top-ups, the volume placed amounted to EUR 979.2 million, which corresponds to a greatly improved placement ratio of 93%[1] (previous year: 82%). At 5.56%, the average annual coupon was on a par with the previous year (2020: 5.57%). According to information provided by the issuers and/or corresponding classifications, one third of the issues were green or sustainable bonds. These are the results of a review of the German SME bond market in the past year conducted by investor relations consultancy IR.on AG.

[1]In addition, five bonds were not taken into account, as subscription for two bonds is still ongoing and no information is available on the placement volume for three others. To calculate the placement ratio, the target volume has also been adjusted for these five bonds.

“The German SME bond market continued to perform well in the second year marked by the COVID-19 pandemic, with both the issue volume and the placement ratio picking up sharply,” said Eric Effey, consultant with IR.on AG. “In spite of two major defaults in the second half of 2021, a stable performance with increasing coupons is expected for the current year.”

Issuers from a wide range of different sectors

In 2021, the 26 SME issuers came from 14 different sectors – an even broader diversification than in 2020 (11 sectors). While the real estate sector was once again most represented, it was no longer as dominant as in the previous years. In 2021, five real estate companies (19%) decided to tap the bond market, compared to twelve (35%) in 2020. However, real estate bonds showed an exceptionally high full placement ratio of 80%, compared to 53% across the board (2020: 39%). The decline may suggest that SME investors apply stricter selection criteria, as real estate bonds from previous years are already heavily represented in their portfolios.

A major change was seen in the form of placement: Only four issues (13%) were purely private placements, while 26 bonds (87%) were publicly placed (2020: 50%). This reflects issuers’ wish to achieve placement security in a sometimes difficult market environment, which is increased by public offerings.

There was a noticeable increase in bond defaults or restructurings, which added up to a volume of EUR 340.7 million in 2021 as a whole (2020: EUR 36.0 million). This is essentially attributable to two issuers, Deutsche Lichtmiete AG and Eyemaxx Real Estate AG, each of which has 4 bonds outstanding with a total volume of just under EUR 266 million and were forced to file for insolvency last year.

Outlook on 2022: Stable SME market and increasing interest rates

For the outlook on 2022, IR.on AG interviewed nine issuing houses that are active in the SME segment. They expect an average of 25 issues for the current year. While last year’s defaults might have a negative impact on investor sentiment, the respondents also see a high need to refinance existing bonds.

“The issuing houses believe that the real estate sector will remain the top sector in 2022. Stronger demand is also expected from companies in the renewables sector,” said Eric Effey.

As regards the coupons, eight of the nine respondents expect them to rise in 2022, mainly because inflation will remain on the agenda and due to investors’ growing risk awareness.

In addition to greater transparency, particularly with regard to the presentation of the business model and financial performance indicators, the issuing houses expect the growing use of ESG ratings and the implementation of ESG standards to raise funds via increasingly popular green bonds.

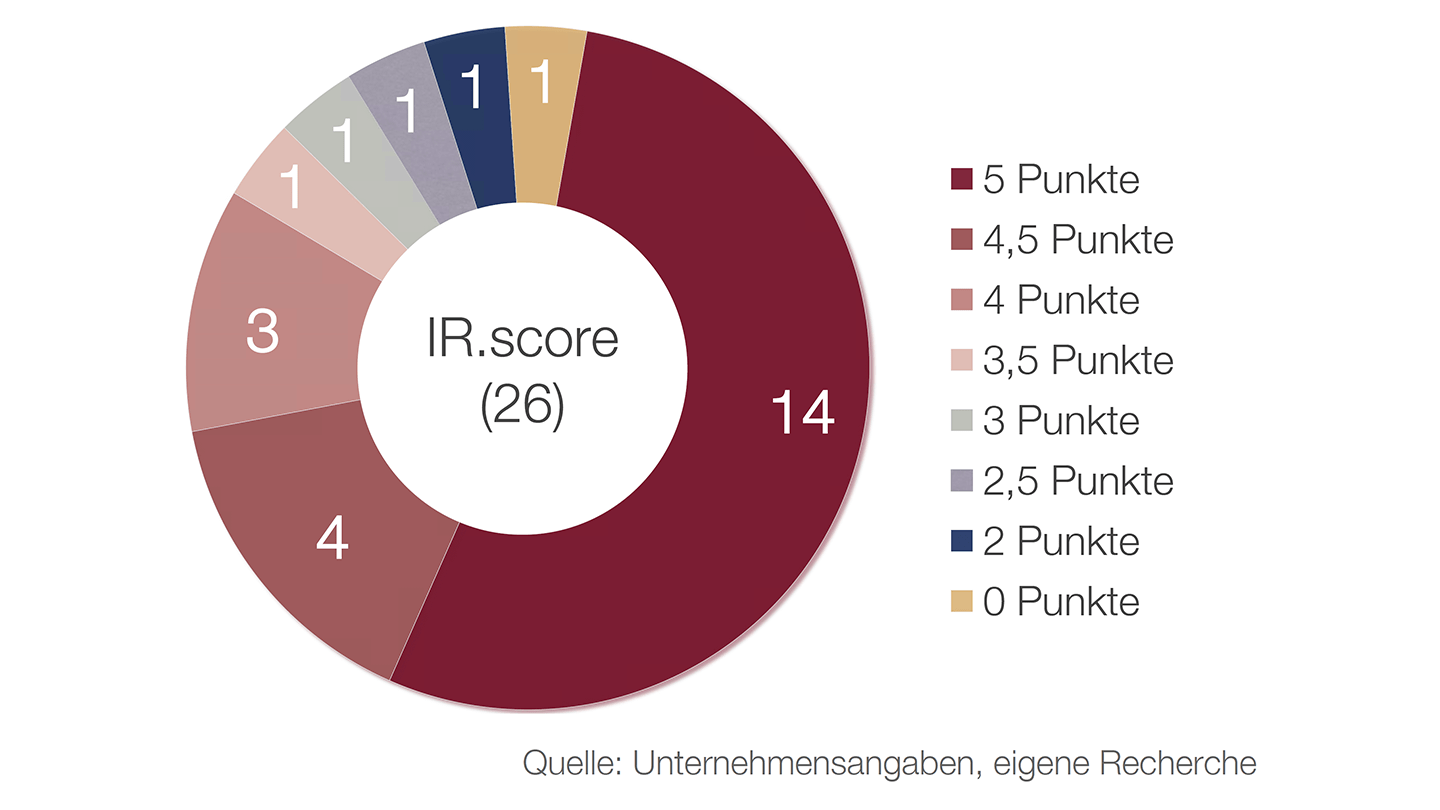

Strong increase in IR.score

On the whole, bond issuers’ communication improved in 2021, judging from the investor relations activities examined in the study. In this year’s review of the IR websites of the 26 issuers with regard to basic IR information, the average “IR.score” transparency index was 4.3 points, compared to 3.8 points in the previous year.

A summary of the survey is available via the website of IR.on AG at https://ir-on.com/en/sme-bonds/.

About IR.on AG

IR.on AG is an independent consulting firm for investor relations and financial communications. The agency assists companies of all sizes in the development of investor relations strategies, day-to-day IR activities, as an interim IR manager, in capital market transactions and special situations such as crises or restructuring exercises, as well as press relations with the financial and business media.

Headquartered in Cologne and Frankfurt am Main, the owner-managed company was established in 2000. The consultants at IR.on AG combine experience from more than 400 communication projects, 300 annual and quarterly reports and more than 100 capital market transactions including 36 SME bond issues.

Contact:

IR.on Aktiengesellschaft

Eric Effey

T +49 221 9140-970

E info@ir-on.com

W www.ir-on.com