Cologne, December 20, 2019 – Anyone who has followed the events surrounding Wirecard, the Bayer/Monsanto takeover and the diesel scandal knows that corporate crises have the potential to destroy value and entail serious consequences in the capital market. In an increasingly complex world, private investors in particular need trust, because they do not only have less financial expertise but are also the only players in the capital market who put their personal savings at risk. Trust is therefore one of the most important goals of corporate communications.

Share Article

In his master thesis Krisenkommunikation am Kapitalmarkt (Crisis Communication in the Capital Market), our new employee Martin Grünter examines the trust-building effect of investor relations (IR). Based on interviews with experts, the thesis addresses the interdisciplinary field between IR and crisis communication, which has been little researched to date.

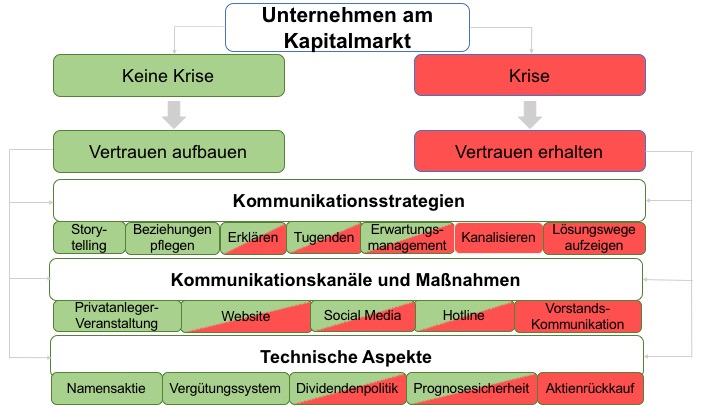

In simple terms, two situations are conceivable for companies operating on capital markets: either there is a crisis or there is no crisis. Depending on which is the case, the task is either to build trust preventively or to maintain it. The model developed on the basis of the study offers recommendations for action in the form of strategies, appropriate channels & measures as well as technical aspects:

Generally speaking, when addressing stakeholders, great importance should be attached to detailed, but also honest, empathetic communication. Especially when dealing with private investors, it is worth explaining and classifying the background, strategies and future plans in detail. In no-crisis times, clever storytelling can help trigger emotions and thus attract the attention of target groups. Furthermore, the private investor event is a very effective preventive instrument. Such events offer an excellent opportunity to explain things in more detail, to foster relationships and to answer questions.

During a corporate crisis, controversial discussions should be channeled to avoid having to address several hotspots at the same time. In such a case, the corporate website is particularly suitable as the key medium for communication. Social media may additionally be used to show investors that they have the possibility to engage in a dialog. By actively highlighting potential solutions, a company demonstrates competence and gains trust. Communication in times of crisis should always be the task of the top management. Only if the management actively takes a stand and admits the problems the company will remain credible.

Technically speaking, the introduction of registered shares is an effective way of addressing private investors. A reliable dividend policy, an appropriate remuneration system or a share buyback program are possibilities to act congruently with communication. Ultimately, however, expectations can only be properly managed and trust be created if the company is able to consistently deliver reliable forecasts.

It should be noted that communication, regardless of the many opportunities it offers, is not a panacea and can never be better than the company behind it. Nevertheless, trust-building investor relations sometimes tip the scales in an investment decision – and not only so for private investors.

If you are interested in the scientific publication, please contact Martin Grünter: martin.gruenter(at)ir-on.com