Share Article

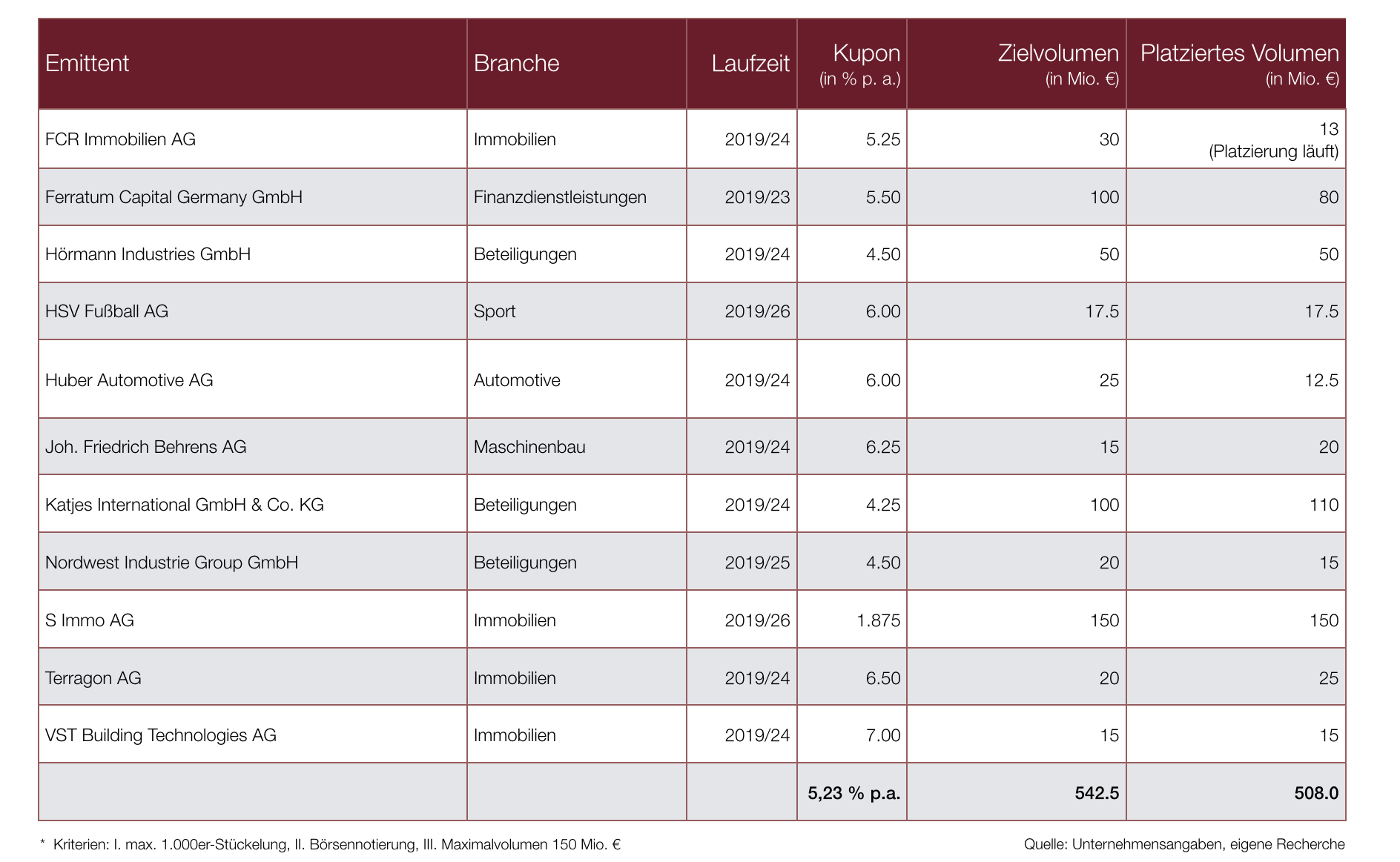

Cologne, 26 July 2019 – The German market for SME bonds again showed a positive trend in the first half of 2019. While the number of transactions declined slightly year-on-year to eleven issues with a volume of EUR 508.0 million (H1 2018: 14 issues; EUR 577.6 million), this represents a strong increase on the years from 2014 to 2017, when only just under seven bonds were placed on average. Moreover, the placement ratio increased to 93.6%, compared to 88.6% in the previous year. The average coupon rose by 34 basis points to 5.23%. These are the results of a review of the German SME bond market in the first half of the year conducted by investor relations consultancy IR.on AG.

The real estate sector remained the clearly dominant industry among the eleven SME bond issuers in the first half of 2019 (4 companies; 36.4% of all issuers). Among these four issuers are two portfolio managers, one project developer and one company from the building technology segment. This shows that, just like in the full year 2018, the real estate boom generally supports demand from investors, regardless of the business model. Investment companies took second place in the sector survey (3 issuers; 27.3%).

Seven of the eleven issues have been placed in full, while one bond is still in the process of being placed. Capital market experience remains a key factor for the success of an issue. The full placement ratio for listed issuers (60%) and follow-up issues (75%) is much higher than that for new entrants to the capital markets. Only one of the three first-time issues was placed in full (33.3%). In terms of volume, most of the transactions were in the EUR 10 to 30 million range (6 bonds). Two issues (Katjes and S Immo) exceeded EUR 100 million. At EUR 150 million (which is the upper limit of the SME segment according to the criteria of the study), the S Immo bond was the largest issue. Most of the issues again had a maturity of five years (7 bonds; 63.6%). No existing bonds defaulted in the first half of 2019.

Half-year survey shows that issuing houses were mostly right in their forecast for 2019

At the beginning of 2019, IR.on AG had asked nine issuing houses that are active in the SME segment for their forecast for the current year 2019. The issuing houses had expected an average of 21 issues for the full year, which was a more optimistic forecast than the one made at the beginning of 2018 (15 expected issues) but more conservative than the actual number of transactions in 2018 (35 issues). The number of issues currently underway and the feedback from market participants suggest that the total number of issues at the end of the year may again exceed the forecast.

So far, the issuing houses have been right in assuming that interest rates would rise slightly and that the real estate sector would remain the dominant segment among issuers. The fact that no SME bond was listed in the General Standard or in the Scale segment of the Frankfurt Stock Exchange in the first half of 2019 also confirms respondents’ expectation that the stock market segment is losing importance for the success of an issue.

IR.score: Transparent companies have greater placement success

Professional financial market communication is more important. At the half-year stage, the IR.on consultants again analysed the IR websites of the eleven issuers with regard to fundamental IR information and gave them a transparency score (“IR.score”). More than one third of the websites (4 issuers) reached a score of 3.5 or lower, which means that they do not meet the information standards expected by investors; two of them were new entrants to the capital market. It is striking that the average IR.score of the fully placed bonds (4.1) is significantly higher than that of the issues that were not placed in full (3.3).

“The results of the first six months once again show that the market for SME bonds has stabilised further and is ready to accept issues,” said Frederic Hilke, consultant at IR.on AG. “It is transparency and professional investor communications which play a key role in the success of a transaction.”

A summary of the survey is available via the website of IR.on AG at https://ir-on.com/en/sme-bonds/ .