Share Article

Cologne | June 2024 – Sustainable bonds have become increasingly important on the capital market in recent years. This is why we took a closer look at sustainable bonds for the first time in our annual full-year study on the SME bond market 2023 and prepared a separate overview. It was noticeable that the market was often unclear about definitions and terminology and therefore also about the actual number of issues.

As part of this analysis, we have therefore taken a closer look at a number of terms, standards and ratings in order to create clarity and provide guidance. The most important findings are summarized below.

When dealing with green bonds, interested parties are soon confronted with a variety of terms, some of which are used synonymously. The term green bond is usually used as an umbrella term, but it can also include social bonds, green bonds, ESG bonds (environmental, social and governance), bonds marketed as environmentally sustainable, or sustainability-linked bonds.

With the Regulation (EU) 2023/2631“EU Green Bond Standard”, the EU is trying to ensure greater transparency for green bonds. The regulation was published in the Official Journal of the EU on the 30th of November 2023. Creating such a standard was a sub-goal of the “European Green Deal”, the European Commission's sustainable transformation strategy. The core contents of the regulation are

Basically, the issue proceeds must be used for environmentally sustainable purposes in order to be able to use the "European Green Bond" or “EuGB” label. This means they must be in line with the EU Taxonomy Regulation. Under certain conditions, the funds raised can also be used for other economic activities. The EU defines a so-called flexibility quota of 15% in Art. 5 of the EuGB Regulation. Use of the label is voluntary and initial application is possible as of the 21st of December 2024.

Another standard already established on the market are the Green Bond Principles (GBP) of the International Capital Market Association (ICMA). This is a voluntary framework designed to promote the transparency and integrity of green bonds. Among other things, the GBPs recommend obtaining a “Second Party Opinion” (SPO). The ICMA has also published guidelines for an external review.

ESG ratings and/or SPOs are commissioned to provide investors with assurance and guidance as well as to ensure the authenticity of a company or bond.

An ESG rating assesses companies regarding environmental, social and governance aspects. There are several rating agencies, which often focus on different aspects and criteria/key figures. Some focus on financially material ESG aspects for the company (e.g. financial impact on the company due to climate change), whilst others focus on the positive/negative impact of the company itself or its products and services on the environment, people and society.

ESG ratings are predominantly concerned with the evaluation of a company with regard to ESG criteria, whereas SPOs usually explicitly examine sustainable bonds. The focal points of an SPO review are, for example

For our SME bond study 2023, the IR.on team has agreed on the uniform use of the term “sustainable bond” to include all three dimensions of ESG. According to our current definition, sustainable bonds are bonds that comply with an ICMA standard or a comparable standard and for which a rating and/or an SPO is available. We believe that when it comes to sustainability, both in sustainable bonds and in reporting, transparency is a key success factor and should be part of normal business practice to avoid, among other things, greenwashing. Therefore, if an issuer advertises with the label “sustainable bond”, it should also stick to what it says on the tin. For this reason, the IR.on team has opted for the above presented “narrow” definition.

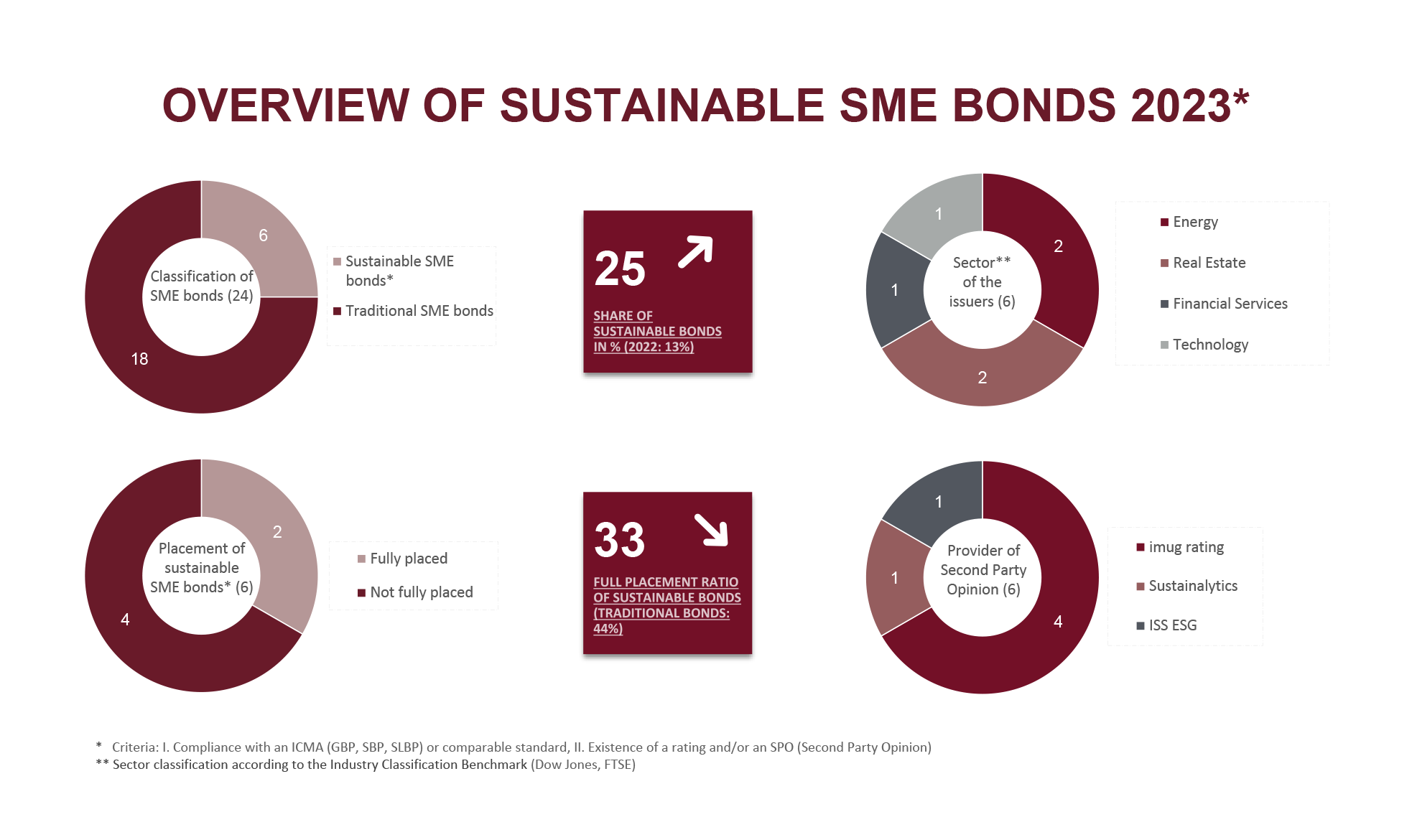

In 2023, six of the 24 SME bonds issued met our criteria and were therefore classified as sustainable in our SME bond study. Measured against the total number of SME bonds issued, the proportion of sustainable bonds increased to 25% compared to the two previous years (13% each).

Overall, however, the success of sustainable bonds on the SME bond market has been modest so far. Only two of the six sustainable bonds were fully placed in 2023 (full placement ratio for traditional bonds in 2023: 44%). The two fully placed bonds were also issued by the two established real estate issuers S Immo AG and UBM Development AG, which had already gained experience with successful ESG bond placements in previous years. Besides this, both issues had the highest target volumes at EUR 75 million and EUR 50 million respectively.

In addition to the real estate companies mentioned, there were two further issuers from the energy sector (target volume of EUR 25 million each) and one company each from the technology and financial services sectors. Even though issuers from the energy sector are generally experiencing increasing relevance supported by the energy transition (a total of eight issues from the energy sector in 2023, making it the sector with the most issues), the difficulties faced by these issuers could be partly due to the fact that the energy transition in Germany, despite its urgency, is progressing slowly, which affects the attractiveness of corresponding bonds.

In the majority of cases, the ESG relevance of the sustainable bonds was certified by an SPO from imug rating (four of the six sustainable bonds). One issuer commissioned Sustainalytics and another one ISS ESG to review and prepare a Second Party Opinion.

As part of our SME bond study 2023, we surveyed nine issuing houses active in the SME segment on the outlook for 2024. For the first time, the development prospects of sustainable bonds and their advantages over “traditional” SME bonds were also surveyed.

Overall, the banks expect sustainability issues to become increasingly important. Seven of the nine issuing houses assume that sustainable SME bonds will account for a share of at least 30% in 2024. Seven banks also see advantages of sustainable bonds over traditional SME bonds and only two issuing houses see sustainable bonds rather as a nice selling point to potentially reassure investors.

Four of the issuing houses surveyed identify regulatory advantages as a key growth driver for sustainable bonds. In this respect, almost half of the banks emphasize the growing regulatory requirements to which both portfolio managers and investors are subject. In particular, the implementation of guidelines and regulations as well as increasing requirements within the framework of the EU taxonomy are seen as a positive incentive for issuers. In addition to the regulatory aspects, broader investor circles and positive attention for sustainable bonds are also cited as advantages. The possibility of using fund mandates that only allow sustainable bonds is a further incentive, to which the EU Disclosure Regulation (Article 8 “light green financial products” and Article 9 “dark green financial products”) also contributes.

The growing relevance of sustainable bonds in the SME bond market is confirmed both by the results of our study and by the survey carried out among issuing houses.

Potential issuers may have to expect additional work and costs when issuing a sustainable bond. In addition to dealing with new standards, which entail extended documentation obligations, there are also costs for commissioning an ESG rating or an SPO if the issuer is considering this.

When looking at the various standards on the market, the “EU Green Bond Standard” is sometimes referred to as a “Gold Standard”. The reason for this is the very high requirements that must be met. It remains to be seen to what extent this voluntary standard will be accepted and used.

Finally, it should be noted that sustainable bonds are not yet an effective selling point in the SME bond market. In our opinion, this is likely to change with a view to future developments, also in view of increasing EU requirements such as the EU taxonomy. ABO Wind AG, for example, set an initial exclamation mark with its debut issue of a listed green bond in May 2024, the issue volume of which was increased from EUR 50 million to EUR 65 million due to high demand. ABO Wind also had imug rating certify that the use of funds complies with the GBP guidelines.

Do you have questions about sustainable bonds or need support with communication in connection with your sustainable bond issue?

Do not hesitate to contact us if you have any questions on this topic or need strategic and communicative support, e.g. with the bond story, website, media planning or investor presentation and hotline in the course of your sustainable bond issue. We will be happy to support you.

IR.on Aktiengesellschaft

Frederic Hilke

Head of Investor Relations

T +49 (0) 221 9140-970

E info(at)ir-on.com