Banks are requesting ESG data, customers are asking sustainability questions, and the risks are becoming more tangible – insurance companies are also taking an increasing interest. Without a clear strategy and defined responsibilities, the necessary data has to be laboriously compiled again and again, often from different areas of the company. This costs valuable time and resources. We show you how to get started with ESG in a structured and pragmatic way – efficiently, without taking on too much.

Sustainability has become part of everyday business life – whether we like it or not. Banks require detailed ESG data for financing and use it to reassess corporate risks. Insurance companies are following suit when calculating premiums. Major customers send out multi-page questionnaires on sustainability measures. And those who cannot provide certain evidence are increasingly falling behind.

At the same time, the regulatory landscape is evolving: even though the EU Commission is currently discussing easing regulations, the basic direction remains clear. Expectations for transparency and sustainability management are rising – regardless of direct reporting requirements.

The starting point in medium-sized companies is often similar: they know that sustainability is important – but where to start? There is a lack of strategy, responsibilities, and data collection. Resources are limited and uncertainty is high.

Why looking away is more expensive than taking action

Some managing directors ask themselves, "Are we even affected?" This is understandable, but short-sighted. The impact is not only felt through direct reporting requirements, but also through the supply chain, banks, customers, and the question of how sustainable a business model is.

Those who are unable to make reliable statements on ESG issues today will experience this in practice in various areas:

- Financing: Banks are increasingly assessing credit risks from an ESG perspective. Without reliable ESG data, companies face higher interest rates or loan rejections.

- Orders: Large customers demand proof of sustainability. Those who cannot provide this will lose orders or be excluded from tenders.

- Reputation: Failures damage the trust of customers, employees, and the public—often with existential consequences for small and medium-sized enterprises.

- Strategic risks: Climate risks, supply chain problems, and regulatory changes are overlooked. New business opportunities remain untapped.

The right start: Structured and without overwhelming demands

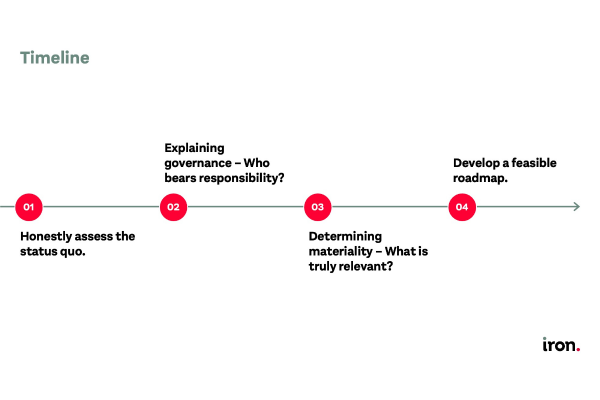

ESG does not have to be a mammoth project. A successful start is based on four steps:

1. Honestly assess the status quo

Before you define goals or plan measures, you need clarity about your starting point. A systematic self-assessment shows which ESG-relevant activities are already in place, where data is collected, and who is responsible. This inventory not only reveals gaps, but also strengths that you can build on.

For an initial overview, we offer a free self-assessment, which you can request from us by email.This allows you to systematically assess your status quo in the areas of governance, strategy, organization & processes, and reporting & communication – a solid foundation for all further steps.

2. Clarify governance – who is responsible?

ESG does not work as a side project. It requires clear responsibilities at the management level. If sustainability is to become strategically relevant, it must be anchored where decisions are made. This is complemented by a coordinating role in operational business – someone who pulls the strings, answers questions, and sets up processes.

3. Determine materiality – What is really relevant?

Not every ESG issue is equally important for every company. A materiality analysis shows which sustainability aspects are actually relevant to your business model, your stakeholders, and your risk situation. What does the bank expect? What are customers asking? This focus prevents you from getting lost in details and concentrates your resources on what really matters.

4. Develop a feasible roadmap

A concrete roadmap is created based on the status quo and priorities. It helps to distinguish between quick wins—measures that have a short-term impact—and long-term projects such as the development of a sustainability strategy. The key is that the roadmap must fit your resources.

How you can get started: The ESG introductory workshop

Our compact, practical ESG introductory workshop will get you in four hours on the right track:

Together with you, we will develop:

- A thorough analysis of your ESG status quo:Where do you really stand? What is already in place, and what is missing?

- The identification and prioritization of your key ESG action areas:Which issues are essential for your company? Where are the risks, where are the opportunities?

- An initial roadmap tailored to your company: With concrete next steps that fit your situation.

The workshop is interactive, with proven templates, coaching elements, and discussion rounds. At the end, you will have clarity about your status, your priorities, and the next steps.